When it comes to building the best investment portfolio, you’ll often hear that diversification is key. But what does that even mean — and why do you need to bother with it? After all, you already own a wide range of stocks, from that skyrocketing Amazon stock to your Apple and eBay stocks, and you’re raking in the profits. What could go wrong?

If you’re relying on a portfolio filled with big tech stocks or energy stocks to get you through to retirement — or if you’re banking on picking the right stocks forever — you may be in for a surprise during the next market downturn. It’s pretty easy to pick the “right” stocks with the market is overvalued. But, when a market correction happens, you’re probably going to be wishing you’d paid more attention to the advice about diversification.

If you want to build wealth and make the right moves for your investments, you need to build a diversified portfolio.

What is diversification?

Have you ever heard the saying, “Don’t put all your eggs in one basket?” That’s the same principle that drives investors to diversify their investments.

When you diversify your investments, you spread your money out across different investment options to lower the risk that comes with investing. In other words, investors use diversification to avoid the huge losses that can happen by putting all of their eggs in one basket.

For example, when you diversify, you allocate a portion of your investments to riskier stock market trading, which you spread out across different types of stocks and companies. When diversifying, you also put money into safer investments, like bonds or mutual funds, to help balance out your portfolio.

The idea behind diversification is that you avoid relying on one type of investment or another. When one of your investments takes a tumble, the others act as a life raft for your money, providing solid returns until the riskier investments stabilize.

Why is diversification important?

A lack of diversification can cause big trouble for your money. That’s because:

- Investing with the main goal of making money immediately is an easy way to lose. Anything can happen in the future. Stocks tumble, markets crash, and fluctuations and corrections happen.

- It’s not enough to diversify the types of stocks you invest in, either. You want to focus on different types of stocks, not just tech or energy stocks, but if the whole market takes a downward turn, or if a correction happens, you need other investments to help balance it out.

- Having a variety of investments in your portfolio is the only way to balance out market downturns. If you don’t diversify, you’re banking on the idea that your investments will always pan out the way you want them to. And, if you ask any seasoned investor, that’s not the best plan.

Let’s say that you think tech stocks are the future. The tech industry is growing at a monumental pace, and you’ve been lucky with your tech stock purchases thus far. So, you take all of your investment money and you dump it into buying stock for large-cap tech company stocks.

Now let’s say that the tech stocks have a steep uphill trajectory, making you tons of money on your investment. A few months later, though, bad news about the tech sector makes headlines, and it causes your cash-machine stocks to plunge, losing you tons of money in the process. What recourse do you have other than to sell at a loss or hold and hope they recover?

Now, let’s say you invested heavily in large-cap tech stocks, but you also invested in small-cap energy stocks or medium-cap retail stocks, as well as some mutual funds, to balance it out. While the other types of investments have lower returns, they’re also consistent.

When your sure-thing tech stocks take a nosedive, your safer investments help to protect you with ongoing returns, and you can better afford the losses from the riskier investments you made. That’s why diversification is important. It protects your money while letting you make riskier investments in hopes of bigger rewards.

Diversification breakdown by age

Diversification is important at any age, but there are times when you can and should be riskier with what you invest in. In fact, most money experts encourage younger investors to focus heavily on riskier investments and then shift to less risky investments over time.

The rule of thumb is that you should subtract your age from 100 to get the percentage of your portfolio that you should keep in stocks. That’s because the closer you get to retirement age, the less time you have to bounce back from stock dips.

For example, when you’re 45, you should keep 65% of your portfolio in stocks. Here’s how that breaks down by decade:

- 20-year-old investor: 80% stocks and 20% “safer” investments, like mutual funds or bonds

- 30-year-old investor: 70% stocks and 30% “safer” investments, like mutual funds or bonds

- 40-year-old investor: 60% stocks and 40% “safer” investments, like mutual funds or bonds

- 50-year-old investor: 50% stocks and 50% “safer” investments, like mutual funds or bonds

- 60-year-old investor: 40% stocks and 60% “safer” investments, like mutual funds or bonds

- 70-year-old investor: 30% stocks and 70% “safer” investments, like mutual funds or bonds

Diversification vs. asset allocation

While asset allocation and diversification are often referred to as the same thing, they aren’t. These two strategies both help investors to avoid huge losses within their portfolios, and they work in a similar fashion, but there is one big difference. Diversification focuses on investing in a number of different ways using the same asset class, while asset allocation focuses on investing across a wide range of asset classes to lessen the risk.

When you diversify your portfolio, you focus on investing in just one asset class, like stocks, and you go deep within the class with your investments. That could mean investing in a range of stocks that have large-cap stocks, mid-cap stocks, small-cap stocks, and international stocks — and it could mean varying your investments across a range of different types of stocks, whether those are retail, tech, energy, or something else entirely — but the key here is that they’re all the same asset class: stocks.

Asset allocation, on the other hand, means you invest your money across all categories or asset classes. Some money is put in stocks and some of your investment funds are put in bonds and cash — or another type of asset class. There are several types of asset classes, but the more common options include:

- Stocks

- Mutual funds

- Bonds

- Cash

There are also alternative asset classes, which include:

- Real estate, or REITs

- Commodities

- International stocks

- Emerging markets

When using an asset allocation strategy, the key is to choose the right balance of high- and low-risk asset classes to invest in and allocate the right percentage of your funds to lessen the risk and increase the reward. For example, as a 30-year-old investor, the rule of thumb says to invest 70% in riskier investments and 30% in safer investments to ensure you’re maximizing risk vs. reward.

Well, you could allocate 70% of your investment to a mix of riskier investments, including stocks, REITs, international stocks, and emerging markets, spreading that 70% across all these types of asset classes. The other 30% should go to less risky investments, like bonds or mutual funds, to lessen the risk of losses.

As with diversification, the reason this is done is that certain asset classes will perform differently depending on how they respond to market forces, so investors spread their investments across asset allocations to help protect their money from downturns.

Components of a well-diversified portfolio

In order to have a well-diversified portfolio, it’s important to have the right income-producing assets in the mix. The best portfolio diversification examples include:

Stocks

Stocks are an important component of a well-diversified portfolio. When you own stock, you own a part of the company.

Stocks are considered riskier than other types of investments because they are volatile and can shrink very quickly. If the price of your stock drops, your investment could be worth less money than you paid if and when you decide to sell it. But, that risk can also pay off. Stocks also offer the opportunity for higher growth over the long term, which is why investors like them.

While stocks are some of the riskiest investments, there are safer alternatives. For example, you can opt for mutual funds as part of your strategy. When you own shares in a mutual fund, you own shares in a company that buys shares in other companies, bonds, or other securities. The entire goal of a mutual fund is to lessen the risk of stock market investing, so these are typically safer than other investment types.

Bonds

Bonds are also used to create a well-diversified portfolio. When you buy a bond, you’re lending money in exchange for interest over a fixed amount of time. Bonds are typically considered safer and less volatile because they offer a fixed rate of return. And, they can act as a cushion against the ups and downs of the stock market.

The downside is that the returns are lower, and are acquired over a longer-term. That said, there are options, like high-yield bonds and certain international bonds, that offer much higher yields, but they do come with more risk.

Cash

Cash is another component of a solid portfolio, and it includes liquid money and the money that you have in your checking and savings accounts, as well as certificates of deposit, or CDs, and savings and treasury bills. Cash is the least volatile asset class, but you pay for the safety of cash with lower returns.

Additional components of diversification

There are other components of diversification, too. As with the other asset classes, these alternative assets are used by some investors to further protect their portfolios. These include:

Real estate or REITs

You can also use real estate funds, including real estate investment trusts (REITs), to diversify your portfolio and provide protection against the risks of other types of investments. Real estate funds work similarly to mutual funds, but rather than investing in a company that buys shares in bonds, stocks, and other common securities, you’re investing in a company that owns, operates, or finances income-generating real estate, like multi-unit apartments or rental properties.

Asset allocation funds

An asset allocation fund is a fund that is built to offer investors a diversified portfolio of investments that is spread across various asset classes. In other words, these funds are already diversified for investors, so they’re often the only fund necessary for investors to have a diversified portfolio.

International stocks

Investors also have the option of investing in international stocks to diversify their portfolios. These stocks, issued by non-U.S. companies, can offer huge potential returns, but as with any other investment that offers the potential for a big payoff, they can also be extremely risky.

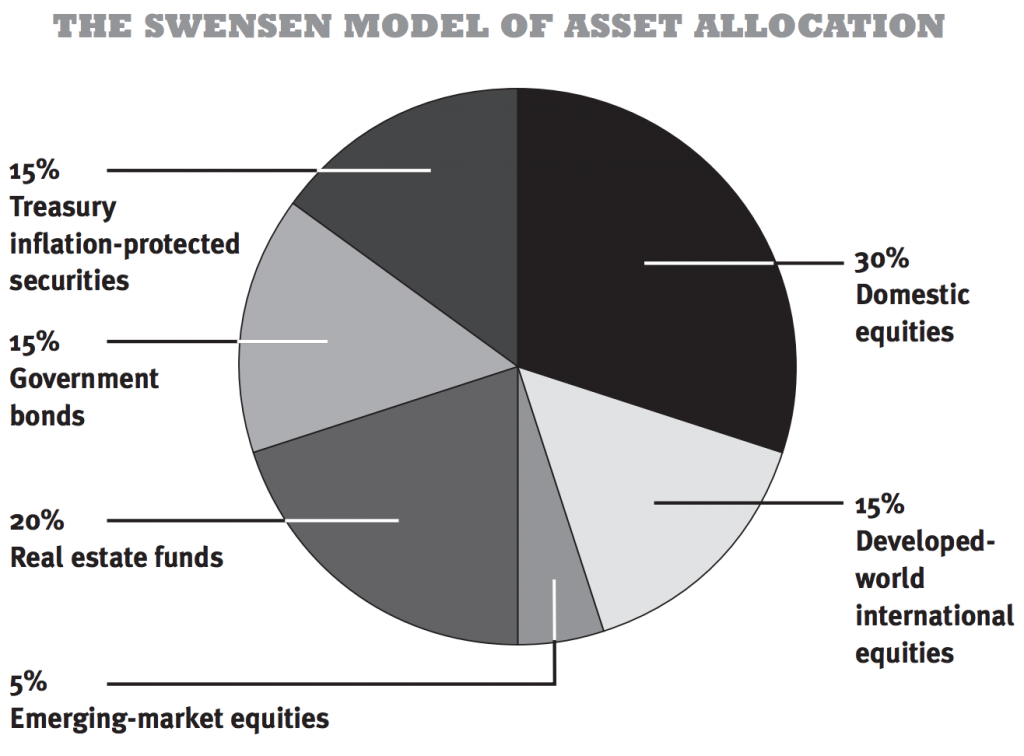

Diversified portfolio example #1: The Swensen Model

Just for fun, we want to show you David Swensen’s diversified portfolio. David runs Yale’s fabled endowment, and for more than 20 years he generated an astonishing 16.3% annualized return — while most managers can’t even beat 8%. That means he’s DOUBLED Yale’s money every four-and-a-half years from 1985 to today, and his portfolio is above.

David is the Michael Jordan of asset allocation and spends all of his time tweaking 1% here and 1% there. You don’t need to do that. All you need to do is consider asset allocation and diversification in your own portfolio, and you’ll be way ahead of anyone trying to “pick stocks.”

His excellent suggestion for how you can allocate your money:

| ASSET CLASS | % BREAKDOWN |

| Domestic equities | 30% |

| Real estate funds | 20% |

| Government bonds | 15% |

| Developed-world international equities | 15% |

| Treasury inflation-protected securities | 15% |

| Emerging-market equities | 5% |

| TOTAL | 100% |

What do you notice about this asset allocation?

No single choice represents an overwhelming part of the portfolio.

As illustrated by the tech bubble burst in 2001 and also the housing bubble burst of 2008, any sector can drop at any time. When it does, you don’t want it to drag your entire portfolio down with it. As we know, lower risk generally equals lower reward.

BUT the coolest thing about asset allocation is that you can actually reduce risk while maintaining a solid return. This is why Swensen’s model is a great diversified portfolio example to base your portfolio on.

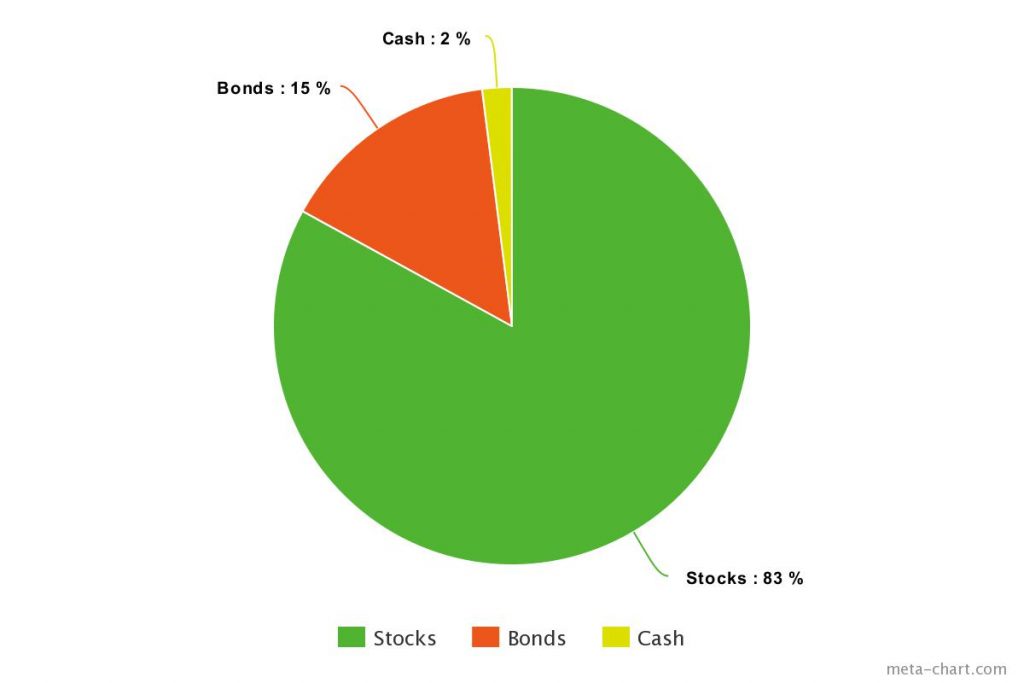

Diversified portfolio example #2: Ramit Sethi’s diversified portfolio example

This is our founder, personal finance expert Ramit Sethi’s investment portfolio.

The asset classes are broken down like this:

| ASSET CLASS | % BREAKDOWN |

| Cash | 2% |

| Stocks | 83% |

| Bonds | 15% |

| TOTAL | 100% |

Here are three pieces of context so you understand the WHY behind the numbers:

Lifecycle funds: The foundation for my portfolio

For most people, Ramit recommend the majority of investments go in lifecycle funds (aka target-date funds).

Remember: Asset allocation is everything. That’s why Ramit picks mostly target-date funds that automatically do the rebalancing for him. It’s a no-brainer for someone who:

- Loves automation.

- Doesn’t want to worry about rebalancing a portfolio all the time.

They work by diversifying your investments for you based on your age. And, as you get older, target-date funds automatically adjust your asset allocation for you.

Let’s look at an example:

If you plan to retire in about 30 years, a good target date fund for you might be the Vanguard Target Retirement 2050 Fund (VFIFX). The 2050 represents the year in which you’ll likely retire.

Since 2050 is still a ways away, this fund will contain more risky investments such as stocks. However, as it gets closer and closer to 2050, the fund will automatically adjust to contain safer investments such as bonds, because you’re getting closer to retirement age.

These funds aren’t for everyone though. You might have a different level of risk or different goals. (At a certain point, you may want to choose individual index funds inside and outside of retirement accounts for tax advantages.)

However, they are designed for people who don’t want to mess around with rebalancing their portfolio at all. For you, the ease of use that comes with lifecycle funds might outweigh the loss of returns.

Conclusion

As an investor, it’s never wise to put all of your eggs in one basket. The key is to find the right strategy, whether that’s focusing on one asset category and going all-in on a wide range of investments within that category or spreading out your investments across all asset classes.

Either type of investment strategy can help reduce the risk while increasing the possibilities of rewards, which is what investing is all about. Make sure you do your research and have the right approach for your needs, and you should be able to reap the benefits that a well-diversified portfolio offers.

100% privacy. No games, no B.S., no spam. When you sign up, we’ll keep you posted

What is a diversified portfolio? (with examples) is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment