I got this question from a reader named Kelsey a while back:

“I haven’t started a Roth IRA yet, but I intend to once I graduate from college. Where should I begin looking for the best one, and how can I tell that they are good?”

Great question. Not only is it important to start investing early, but you should also make sure that you pick the right accounts to do it in.

That’s why I’m going to show you how to evaluate a good brokerage as well as give you my recommendations for which ones you should open.

- The 5 best IRAs of 2020

- How to find the best IRAs

- How to open an IRA

- What’s an IRA and why should I have one?

- REMEMBER TO INVEST!

- Automatic investing

The 5 best IRAs of 2018

Below are some of my favorite IRAs for 2018. When you’re done checking out the recommendations, be sure to keep reading to find out how you can set up an automatic system so you invest passively.

1. Vanguard – Best Funds

Vanguard is what I use — and they’re a fantastic brokerage due to their low-cost funds and great customer support. They’re a tried and true option when it comes to the investing world.

- No account minimum

- Automatic investing

- Most funds require a minimum $3,000 BUT there are funds you can purchase for as low as $1,000

- $20 account service fee BUT it’s waived if you sign up for their statement e-delivery service

- Commission-free ETFs when traded within your brokerage account

2. Charles Schwab – Best Overall

Schwab is a very reputable and reliable brokerage on top of offering one of the best checking accounts out there. Plus if you do have a checking account with Schwab, they’ll automatically link the brokerage account to it. Very handy for automatic investing.

- No minimums to open account

- No maintenance fees

- No commissions for Schwab ETFs

- Low-cost funds

- Automatic investing

3. Ally – Best Rates

Ally is an online bank — and they’re a great choice for anyone looking for an IRA. Since they’re online, they don’t have to deal with a bunch of overhead and pass their savings onto their clients.

- No minimum opening amount

- No maintenance fees

- Low commissions

- Offers many other IRA products like IRA CDs and IRA Online Savings Accounts to add to your account.

Betterment – Best for Hands-Off Investing

Betterment is a fantastic option if you’re looking for a painless, hands-off investing experience. They’re a robo-advisor that provides customers with features like automatic rebalancing for when your stocks and bonds start to stray from your wanted asset allocation. They’ll also let you determine your own risk tolerance to help you build a great portfolio that’ll work for you. Overall, a great choice if you’re looking for a robo-advisor.

- No minimums to open account

- 0.25% management fees

- Automatic rebalancing

- Automatic investing

- Goal-setting tools

Fidelity – Best for Newbies

Fidelity offers an intuitive experience for anyone just getting started in investing, while providing plenty of lucrative funds and hands-on tools for those more experienced in investing too. The platform also comes with no fees for trading funds yourself, and they also host a big catalog of great ETFs. If you’re looking for a broker to help you trade, though, you might find yourself saddled with a fee to do so. Overall, it’s a great place to start if you’re new to investing.

- No minimums to open account

- No fees per trade

- Great catalog of ETF options

- 24/7 customer service

How to find the best IRAs

Contributing as early and as much as possible is important since each dollar you invest will be worth much, much more with time.

To start, you’re going to need to open an investment brokerage account with a trusted investment company. Think of the “investment brokerage account” as your house, and the IRA as one of the rooms.

Although this account will probably hold only your IRA, you’ll be able to expand it to hold other accounts later (e.g., taxable investment accounts or additional IRAs for your spouse and kids).

When it comes to finding a good IRA, you need to look at three areas:

1. Low open fees

You’ll want to compare minimum required investments before you open the investment account. For example, some full-service brokerages require you to have a hefty minimum amount to open an account.

A while back, I called up Morgan Stanley and a representative recommended a minimum balance of $50,000.

“Technically, you can open an account with $5,000,” she said, “but the fees would kill you.”

This is why you use a discount brokerage. Most do require a minimum fee of $1,000 to $3,000 to open an IRA — but sometimes they’ll waive it if you set up an automatic transfer fee. Which brings us to…

2. Automatic investment

The second thing you want to look for is an IRA that’ll allow you to automatically invest your money.

IWT is all about automation. It takes the pain out of investing yourself each month and allows you to put a financial system in place that’ll earn you money passively.

With an IRA automatic transfer, your brokerage will automatically take money out of your checking account each month and invest it where it needs to go.

Even if they don’t, that’s okay. You can set up a monthly automatic transfer so your money will grow without you having to think about it (more on that later).

3. Good features

You should also investigate the features of the account.

Will you have 24/7 customer service? Is the online interface easy to use? Are there reputable fiduciaries ready to answer any question you have? You should be able to call them up on the phone and get recommendations for people like you to invest.

While you should absolutely spend some time looking for an IRA with those three things, the important thing is you get started.

Yes, you could spend hundreds of hours doing a detailed comparison of the total number of funds offered, frequency of mailings, and alternative-investment accounts available, but more money is lost from indecision than bad decisions.

Just pick one of the three above and get started.

How to open an IRA

All of these places offer an excellent variety of funds to choose from, so you can’t go wrong with them.

Signing up is easy too. Follow the steps below to open one up today.

NOTE: Make sure you have your social security number, employer address, and bank info (account number and routing number) available when you sign up, as they’ll come in handy during the application process.

- Step 1: Go to the website for the brokerage of your choice.

- Step 2: Click on the “Open an account” button. Each of the above websites has one.

- Step 3: Start an application for an “Individual brokerage account.”

- Step 4: Enter information about yourself — name, address, birth date, employer info, social security.

- Step 5: Set up an initial deposit by entering in your bank information. Some brokers require you to make a minimum deposit so use a separate bank account in order to deposit money into the brokerage account.

- Step 6: Wait. The initial transfer will take anywhere from 3 to 7 days to complete. After that, you’ll get a notification via email or phone call telling you you’re ready to invest.

- Step 7: Log into your brokerage account and start investing!

The application process can be as quick as 15 minutes and will put you on your path to a Rich Life.

What’s an IRA and why should I have one?

An individual retirement account (IRA) is an investment account that gives you amazing tax advantages for retirement saving.

The two common types:

- Traditional IRA. This account allows you to invest pre-tax income. You’ll roll over your 401k into a traditional IRA whenever you leave a job. Currently, anyone younger than 70 ½ -years-old is allowed to contribute to a traditional IRA. Once you hit that age, you are required to take out a minimum withdraw each year that is a specific percentage of your funds.

- Roth IRA. This account uses your after-tax money to invest, giving you an even better deal on your investment, as you’ll also pay no taxes on any gains when you withdraw on it. There are currently no age restrictions on a Roth IRA — however, there are income restrictions.

Currently, there’s a yearly maximum investment of $6,000 to both accounts ($7,000 if you’re more than 50 years old). A Roth IRA currently has an income limit of $135,000 for single tax filers and $199,000 for married couples joint filing. A traditional IRA has no such limits.

However, these limits change often, so be sure to check out the IRS contribution limits page to keep updated.

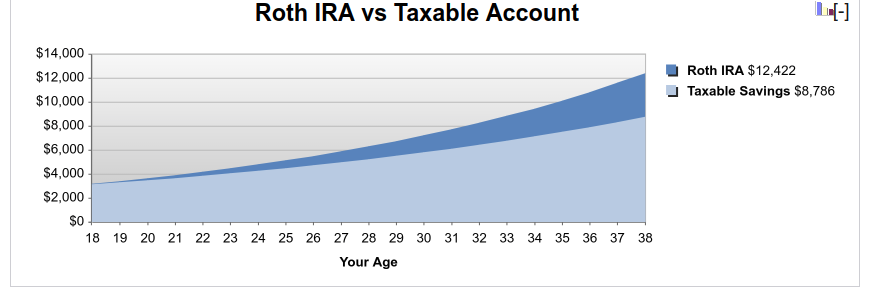

Though there are advantages to both IRAs we highly recommend you get a Roth IRA. It’s one of the best investments you can make as a young person. It’s simply the best deal I’ve found for long-term investing.

If Roth IRAs had been around in 1970 and you’d invested $10,000 in Southwest Airlines, you’d only have had to pay taxes on the principal amount. When you withdrew the money 30 years later, you wouldn’t have to pay any taxes on it…

…which is good because that $10,000 would have turned into $10 MILLION.

Overall, time is your best friend when it comes to your Roth IRA. And over many, many years, that’s an amazing deal.

REMEMBER TO INVEST!

An IWT reader wrote me about a conversation she had with her friend a while back. The friend mentioned she’d been contributing to her IRA for almost 20 years.

And then … she sent me this email.

“Wow that’s great!” I said. (The IWT reader.)

“Yeah, but it’s barely increased at all.” I felt a sinking feeling.

“You know you have to buy the funds right? It’s not enough to transfer money into an IRA, you have to choose the allocation.”

“What?” she said.

RAMIT, MY FRIEND HAS BEEN PUTTING MONEY INTO A ROTH FOR OVER 10 YEARS AND NEVER SELECTED FUNDS. IT’S A GLORIFIED SAVINGS ACCOUNT. SHE’S MISSED 10 YEARS OF INVESTMENT GROWTH WITH COMPOUND INTEREST. I DON’T KNOW IF I’M MORE ANGRY OR SAD.

Holy shit.

She’s right. Very few experts are ever crystal-clear in telling you that you need to actually INVEST your money when you have a Roth IRA (you can find these instructions in Chapter 7 of my book).

The worst part? The $3,000 her friend “invested” could have been worth more than $12,000 today. That’s $9,000 in EFFORTLESS money — and because it’s a Roth IRA, those earnings would have been tax-free.

You know I had to ask how her friend felt when she learned the truth.

“I feel kind of cheated,” she says. “I could have been earning more money for all of these years, yet no one ever told me about this important step.”

This is why I started writing IWT. This woman went out of her way to get educated. She went as far as opening a Roth IRA and even contributed thousands of dollars. But because she didn’t understand the tiny technical features of this retirement account, she lost out on $9,000 of tax-free earnings.

Should she take some responsibility for not knowing exactly how a Roth IRA worked? Of course.

But it shouldn’t be this hard. You shouldn’t have to be a financial expert to have your money do the right thing, just like I shouldn’t have to understand how a carburetor works to drive my car.

That’s why I wrote my New York Times best-selling book on personal finance — so you could use my financial system, and in six weeks, automatically make your money go where it needs to go.

Get your copy here.

So remember: An IRA is just an account. Once your money is in there, you have to start investing in different funds to see your money grow. I love target-date funds for most investors, which you can find in Chapter 7 of my book.

Invest in your IRA automatically

Finding a great IRA to begin investing is just the first step to saving for your future. If you REALLY want to build a financial system that’ll help you earn money passively, you need to automate your finances.

To help, I’ve created a 12-minute video on how to do exactly that. Just enter your name and email below and I’ll show you how to create a personal finance system that’ll save and earn you money passively for years to come.

The 5 best IRAs to open in 2020 is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment