Buying a home for the first time can be like walking through a minefield. One wrong decision can be costly, life altering, and downright terrifying.

On top of that, it seems like everything is working against you. A lot of home buying advice is misleading (or downright bad) despite the fact that buying a house is often the biggest financial decision people ever make.

That’s why we want to help.

Below you’ll find all the best advice and tips we have for you to become a first-time home buyer — without losing your shirt in the process.

- First-Time Home Buyer Mistakes to Avoid

- First-Time Home Buyer Programs to Be Aware Of

- Other Financing Options To Consider

- 3 Tips to Streamline Your Buying Experience

First-Time Home Buyer Mistakes to Avoid

Remember: Buying a home is like walking through a minefield. You need to avoid making mistakes — or the consequences will be huge.

Here are a few you should be aware of:

Mistake #1: Having bad credit

If you want to buy a house by getting a home loan, you need to make sure you have your credit score in check.

Not doing so could result in tens of thousands of dollars lost over the course of your mortgage.

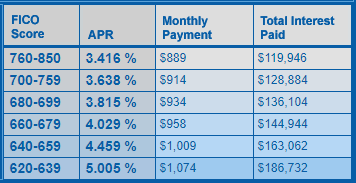

That’s not an exaggeration either. Imagine two people: One has a great credit score of 790 and the other has a low credit score of 630. Both are looking to get a $200,000 30-year fixed-rate home loan.

How much do you think they’ll each pay in interest? Take a look:

Source: MyFico.com, calculated December 2019

The one with a bad credit score will end up paying $66,000 more than the one with a good credit score! That’s assuming they are able to get a mortgage at all with a score like that.

If your credit score isn’t the best, you’ll want to improve it. Here are a few resources from IWT that’ll help you do just that.

- How to get out of debt fast

- Check your credit score — the most ignored Big Win

- Pay off your credit card debt

Mistake #2: Not knowing how much you can afford

Knowing how much house you can afford is a crucial step to deciding whether or not to buy for the first time.

This allows you to get the correct loan for your financial situation — helping ensure that you can pay it off each month without worrying about it.

How do you find out how much you can afford? Simple: With the 28/36 rule.

This is the same system used by lenders to determine how much you can afford. And it’s simple:

- Your max household expenses shouldn’t exceed more than 28% of your gross monthly income. Including everything within your home payment.

- Your total household debt shouldn’t exceed more than 36% of your gross monthly income. This is also known as your debt to income ratio.

For example, if you earn $4,000 / month in gross income, the best mortgage you’re likely to attain would be no more than $1,120 / month — because that’s 28% of your gross income.

By that same rubric, if your debt is at or exceeds $1,440 / month, you probably should focus on paying down your debt rather than buying a house.

If you want to learn more on this topic (and you should) be sure to check out our article all on how much house you can afford.

Mistake #3: Spending all of your savings

If you intentionally saved money for a house down payment in a separate savings account, then congrats! You’re in a small minority of finance savvy individuals who do things right.

If you plan on blowing all of your savings on your house downpayment, then I HIGHLY urge you to reconsider. Not only is this ill advised, but it could potentially lay the foundation for a lot of financial hardships in the future.

A recent survey by Bankrate discovered that just 18% of Americans had enough money for six months of expenses in case of emergency. That means just a fraction of Americans are prepared for the worst financial crises of their lives.

If you’re one of those without a savings account for your down payment or an emergency fund, I have a great system to help you save for both painlessly: Automated savings (more on this below).

First-Time Home Buyer Programs to Be Aware Of

First-time home buyer programs are assistance programs that will help you purchase a home through good interest rates, tax breaks, and financial grants.

As expected, they all have stipulations to them (e.g. you must be active-duty military). Here are a few that we suggest though:

FHA loan

This is the Federal Housing Administration Loan — and it’s great for home buyers with low credit scores.

In fact, if your credit score is 580 or higher, you can be approved for a loan with 3.5% down payment. If your credit score is between 500 and 579, you can be approved for a loan with a 10% down payment.

There is a catch: FHA loans require home buyers to purchase mortgage insurance. You’ll be required to pay two premiums: An upfront premium and an annual premium. This will drive up the cost of your overall home buying experience.

For more, check out the US Department of Housing and Urban Development website here.

VA loan

This is a loan available to veterans and active-duty military. If that’s you, you can get a pretty lucrative deal with a VA loan when compared to conventional loans.

How lucrative? With a VA loan, you might not need a down payment, you’ll get low interest rates, and they offer protections for if you default on your loan.

There’s also no mortgage insurance premium requirement and you don’t have to be a first-time buyer to take part.

For more, check out the VA loan website.

USDA loan

That’s right. The same people who make sure your steaks are certified safe to eat offer a great loan program.

The United States Department of Agriculture provide something known as the “Single Family Housing Guaranteed Loan Program” for low to moderate income earners. It’s goal: Get potential home buyers to live in rural areas of the country.

Some benefits include:

- No down payment

- 100% financing

- Low credit score requirements

Of course, you can only live in USDA approved areas. But don’t worry, they don’t expect you to live in a ranch or farm.

For more, check out the USDA loan website.

Good Neighbor Next Door

This loan is offered by the US Department of Housing and Urban Development (HUD). It’s aimed to help “law enforcement officers, pre-Kindergarten through 12th grade teachers, firefighters, and emergency medical technicians” to attain a home.

If you meet that requirement, a Good Neighbor Next Door loan can help you get a 50% discount off of a house’s list price — which is amazing.

Of course, there are some stipulations. You have to commit to living on the property for at least 36 months as your only residence. And the house must fall in a “revitalization area” as designated by the HUD (find eligible properties on their website here)

For more, check out the HUD website.

Other Financing Options To Consider

Some other financing options you might want to consider include looking at a non-profit home buying assistance organization. Places like Habitat for Humanity and the Neighborhood Assistance Corporation of America help provide homes to low income earners.

If you’re looking for additional financing, though, our best advice would be to save more money for the down payment. That means automating your finances so you save money passively and pain free.

And it’s simple: Each month when your paycheck comes, the money is automatically sent to everywhere it needs to go (bills, savings, retirement, etc). That way, you don’t have to go through the pain of manually depositing money into a savings account because your system is set up to do it for you.

To learn how to set up this system, check out this video.

3 Tips to Streamline Your Buying Experience

When it comes to buying a house, you want to make sure that you’re as prepared as possible before you even consider looking at places.

To help, here are three quick tips for you to keep in mind when beginning the process:

- Check your credit report. Not just your credit score. We’re talking about the report. You will want to make sure that there are no mistakes on your report that may be negatively impacting your credit score and fix them asap. To learn how to do that, check out our article on disputing errors here.

- Find a property inspector. A certified property inspector is a third-party professional who will go through your house to check it for damage, structural flaws, and repairs. They will furnish a complete report of the house that you can then use for potential negotiations on the price or repairs. This is crucial. You do not want to make the mistake of not getting a property inspector. It might cost you untold amounts of money if you do.

- Pay off your debt. Why? Simple: Owning a house is expensive. That’s because houses come with phantom costs besides the mortgage. Things like repairs for when your pipes suddenly burst, or when a tree branch falls through your roof. These unexpected things can and will happen. When they do, you want to make sure they don’t lose your shirt with it.

Summary / Conclusion

Buying a house is one of the biggest financial decisions you’ll ever make. That’s why you want to take the time to seriously research and consider the decision.

Here are a few of our best articles on the topic to help you out:

- The 5 steps to buying a house

- Don’t buy a house without asking yourself this question

- The propaganda to buy a house

- Real estate investing: The myths, facts, and ways to get started

No matter what you end up doing, be sure to check out IWT for more on great personal finance and development advice.

The Complete Guide for First-Time Home Buyers is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment