Knowing how to build a budget is a crucial step to financial success.

Once you learn how, you can achieve financial goals like:

- Save money for big purchases (e.g. weddings, cars, houses)

- Pay off student loans, home payments, and credit card debt

- Create an emergency fund

- Invest for retirement

… and much more.

But building a budget can be a pain — especially if you rely on “traditional” budgeting methods.

Nobody wants to stare at the same spreadsheets each weekend, slaving over a hot calculator, and manually entering in how much they spent on groceries that week.

Luckily, there’s a better way with Tiller Money.

Tiller Money is one of the best new ways to create a budget without going insane. It’s an online tool that allows you to easily audit your finances and automatically tracks your money month-to-month.

It combines all of the best things about the IWT philosophy:

- Automation. Your spending is automatically uploaded into a Google Sheet where you can see exactly how much you spent in a variety of customized categories like food, shopping, or travel.

- Conscious spending. You’ll be able to spend your money consciously once you know exactly how much you have to spend for each category. No more guessing how much you have to spend in a month.

Tiller is easy to set up and even easier to use. Let’s take a look at how you can get started with the service today.

Get Your Spreadsheets Ready

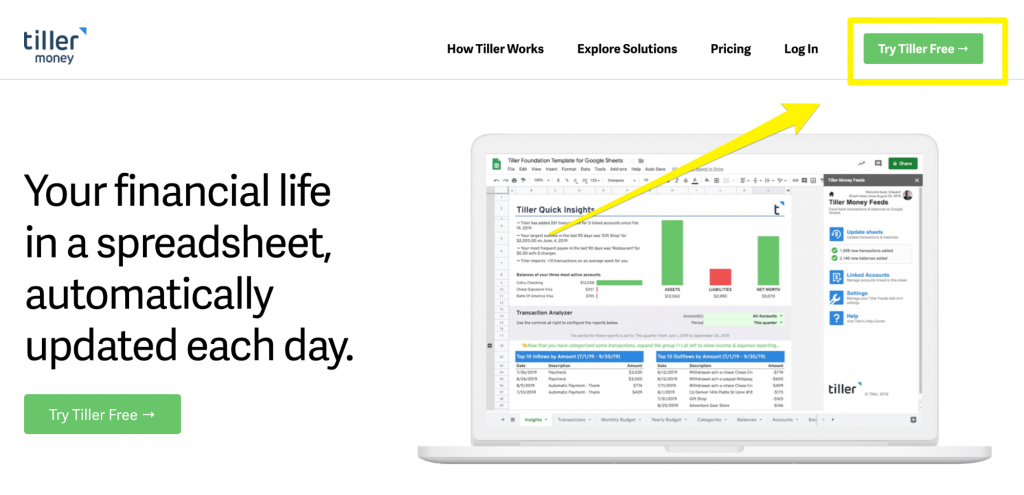

To start, head on over to TillerHQ.com and click on Try Tiller Free in the top right corner.

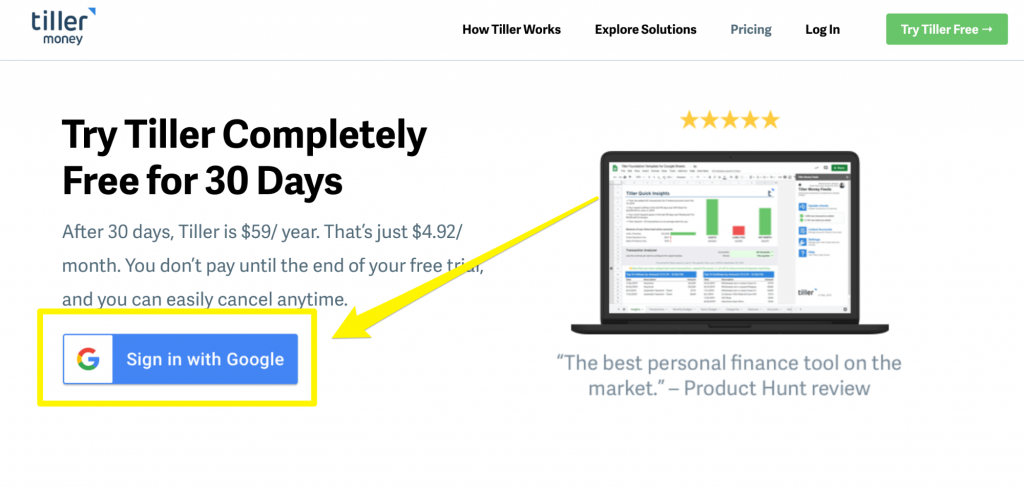

Then, click Sign in with Google. If you don’t have a Google account, create one and then return back to this page and click the button.

NOTE: Tiller Money comes with a 30-day free trial. After that it costs just $4.92 / month or $59 / year.

On the next page, you’ll have to enter your payment information for the subscription. Don’t worry. You can cancel the subscription anytime within the 30 day trial and your card won’t be charged.

Once you submit your payment information, click on Link an Account. Tiller Money will then walk you through the process of connecting with a bank account you want to track.

When you’re finished, you’ll then be able to create a spreadsheet for your budget.

Click on either Start with Google Sheets or Start with Microsoft Excel.

For this tutorial, we’re going to use Google Sheets as it’s a simpler, more straightforward way to manage your budget with Tiller.

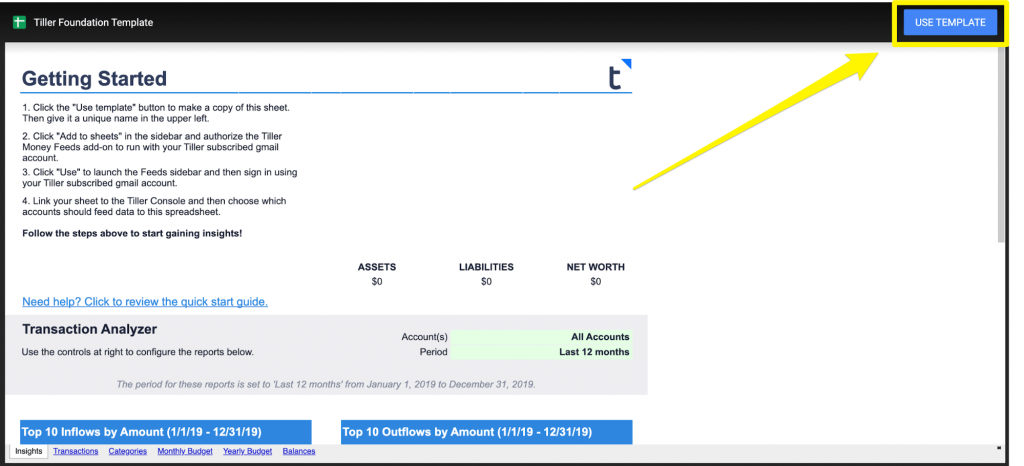

You’ll then be sent to the Tiller Foundation Template, which you can add to your Google Drive to start budgeting.

The directions are under Getting Started. Here they are (courtesy of Tiller):

- Click the Use template button to make a copy of this sheet. Then give it a unique name in the upper left.

- Click Add to sheets in the sidebar and authorize the Tiller Money Feeds add-on to run with your Tiller subscribed gmail account.

- Click Use to launch the Feeds sidebar and then sign in using your Tiller subscribed gmail account.

- Link your sheet to the Tiller Console and then choose which accounts should feed data to this spreadsheet.

Once you link your accounts to your Tiller sheet, you’re then ready to get started auditing your budget.

Audit Your Current Money Situation

A budget audit is a look into your finances over a period of time. For example, you can do a budget audit to look over how much you spent, saved, and earned in a previous week.

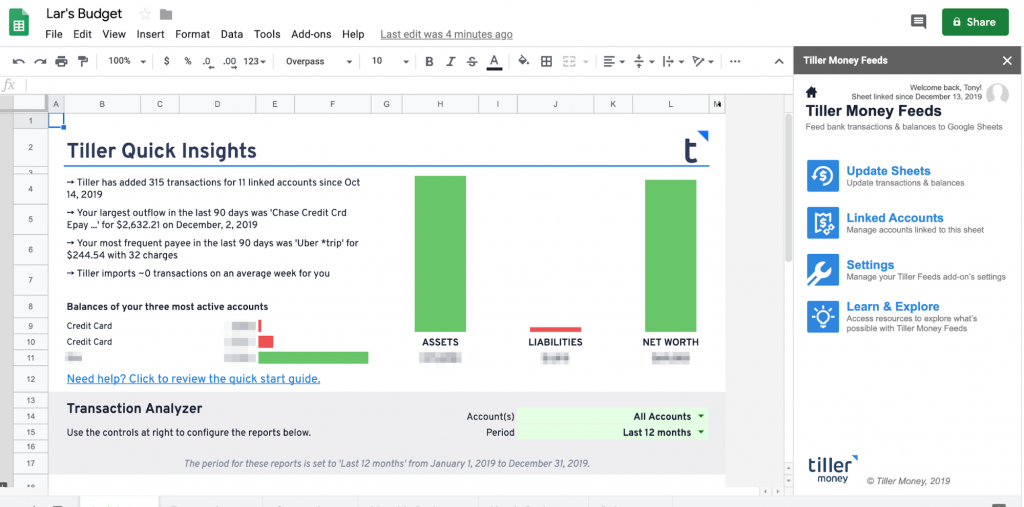

Tiller helps break down your finances in a simple way that allows you to easily audit all of your spending.

On the first page of the budget template, the sheet gives you insights on your assets, liabilities, and net worth.

This gives you a quick overview of your finances as a whole.

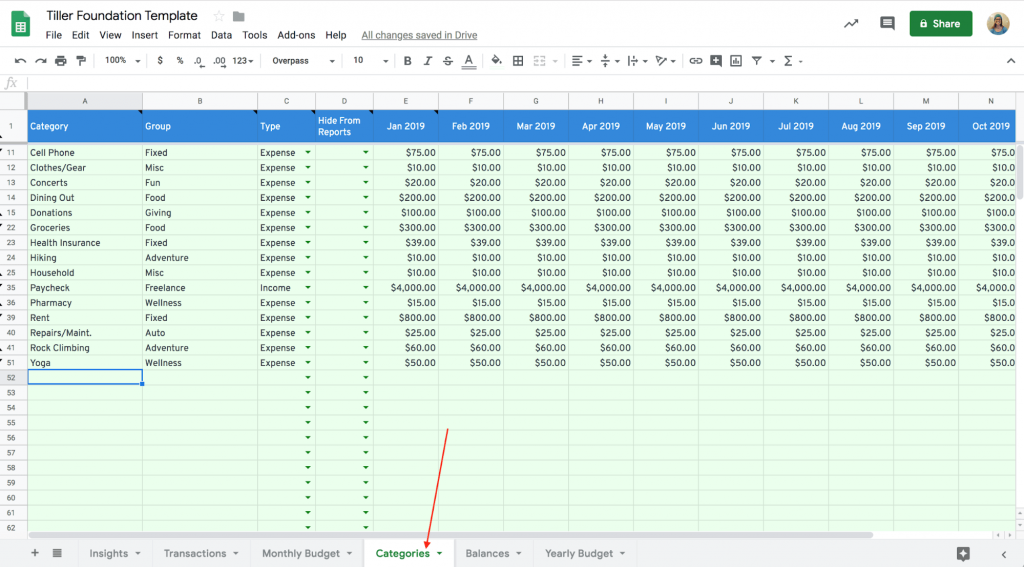

Tiller allows you assign each of your expenses a different category such as Dining Out, Rent, Repairs, Yoga, and more.

To change your categories, go to the categories tab at the bottom.

Source: Tiller HQ

In here, you can add new categories, or edit new ones to determine the type of transaction they are (Expense, Income, or Transfer). You can also choose the amount you want to budget for each category month-to-month.

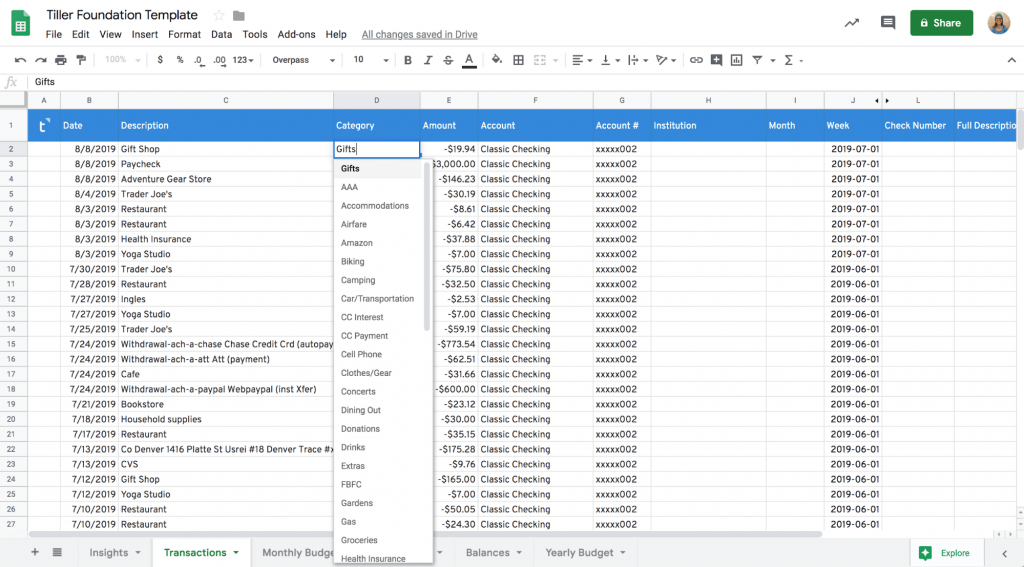

Once you finish that, go to your Transactions tab.

Source: Tiller HQ

From here, you’ll be able to categorize each of your transactions according to their category. Do so for as many transactions as you’d like. The more that you categorize, the more accurate your budget will be.

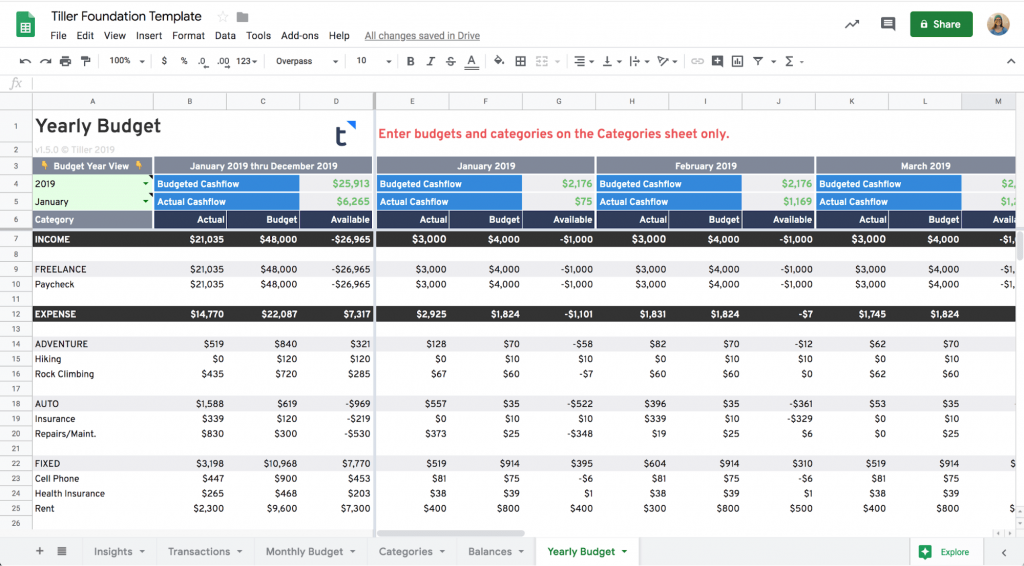

Once you finish, go to the Yearly Budget tab.

From here, you’ll be able to take a look at your budget and see how your income and expenses are impacting it.

This allows you to see exactly where you’re spending, and if you’re in line with your goals.

Determine Your Approach to Budgeting

Though there are a lot of different ways you can approach budgeting, here are three we suggest:

The Envelope Method

This method is a great way to be conscious with your spending.

And it’s simple: You allocate cash for things such as dining out, shopping, and groceries in physical envelopes. Each time you need to use money, you turn to the envelopes.

For example, if you want to go eat at that new restaurant down the block for lunch, you’ll dip into your “Dining out” envelope. Once you run out of money, that’s it. You can’t spend anymore.

This is a good way to make sure you’re on track with your budget since you can physically hold the amount you have left for that category.

A good alternative to this method is using a debit card dedicated to a category. For example, you might have a debit card specifically for grocery purchases. This is especially helpful if you want to keep track of your budget on Tiller.

50/30/20 budget

This approach offers a good rule of thumb for your monthly spending.

50/30/20 refers to how much you allocate to different areas of your life:

- 50% for needs such as rent, bills, food.

- 30% for wants such as drinks, travel, and eating out.

- 20% for savings such as investments or savings goals.

You can tweak these numbers so they work for you — but it’s a solid rule of thumb for anyone looking for a straightforward way to save and spend without going crazy.

Values-based Budget

This budget system lets you prioritize yourself over your budget.

All you have to do is make a list of the things in your life that you prioritize. Some examples:

- Food

- Shelter

- Entertainment

- Fitness

- Children

Then calculate the monthly cost of each item. When you have your numbers, input your monthly income and see how much you can spend in each.

This method is going to take some time and tinkering. If you find that you can’t fit your income into all of the items, then you’ll have to reprioritize your spending.

This system is best for people who aren’t the best at budgeting, since we start by getting away from numbers. Instead, you take a look at the areas in life that you love to spend on. By approaching it with positive emotions first, you make budgeting that much easier.

Review Your Budget Monthly

We suggest you review your budget each month. This helps ensure that you’re on track with your savings, and that your actual spending isn’t breaking your budget goals.

And with Tiller, it’s a simple 3 step process:

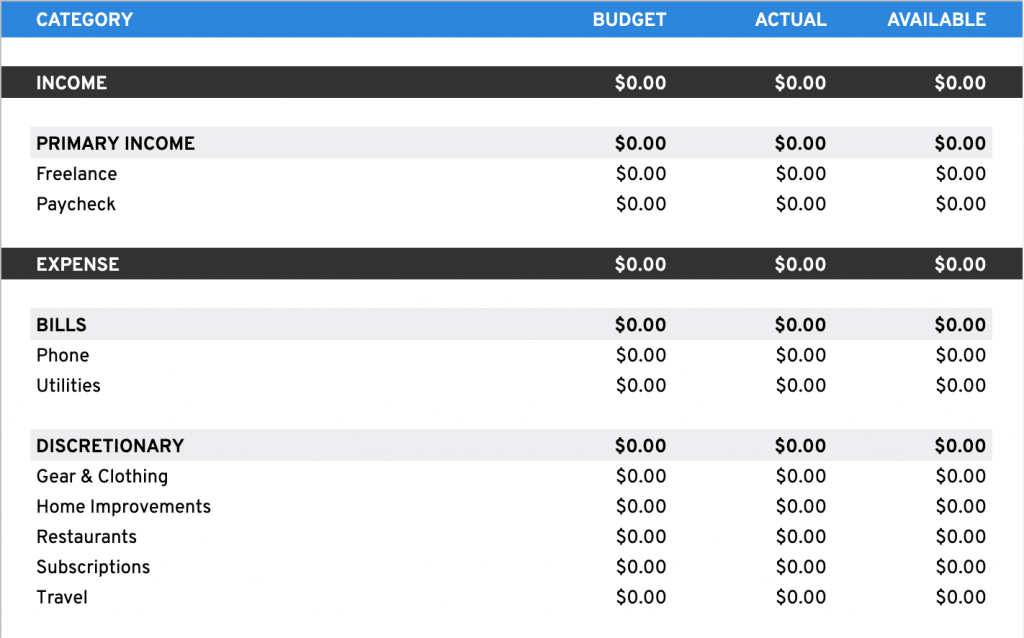

- Step 1: Go to the Monthly Budget tab at the bottom of the spreadsheet.

- Step 2: Using the dropdown menu in the right corner, choose the month and year for the budget and expense you want to see.

- Step 3: Compare your actual spending against your budgeted spending by scrolling down and looking at your expenses.

There are three columns for your budget:

- Budget. How much you budgeted for that category

- Actual spending. How much you actually spent in the category

- Available spending. How much you have left in the budget to spend in the category

It’s okay if you’re over your limit by a little bit. That happens from time to time. If you’re over your limit by a lot, however, it might be time to either readjust your spending in that category, or revising your budget so it’s more realistic.

How much is a lot or a little depends on you and your finances.

Budgeting Is a Work in Progress

Good budgeting takes constant work, and continuous improvement.

It’s easy to setup a budget one time, and then never look at it again. The magic happens when you MAINTAIN. Be ready to adjust as you go, and learn based on your reviews.

How to Build a Budget is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment