Errors and your credit history. Name a more iconic duo. I’ll wait.

You can’t.

Errors in your credit can occur for a variety of reasons, from simple reporting issues from the creditors’ side to more serious issues like identity theft. No matter what the reason is, though, you’re going to need a good credit dispute system in place to take care of it.

To make sure your credit is in the best shape, you’ll want to make sure you do two things:

- Dispute errors on your credit report

- Dispute credit card charges you didn’t make

This is a key step to improving your credit score, getting out of debt, and living a Rich Life. That’s because even the smallest error can have huge ramifications on your personal finances.

For example, if you’ve been timely with paying your debts, yet your credit report says you’ve been late on them, nearly a third of your credit score will be negatively impacted by this error. This could prevent you from securing home and car loans as well as being approved to rent apartments.

Let’s take a look at each credit dispute system now, and break down exactly how you can improve your credit with each.

Credit dispute system #1: Credit report errors

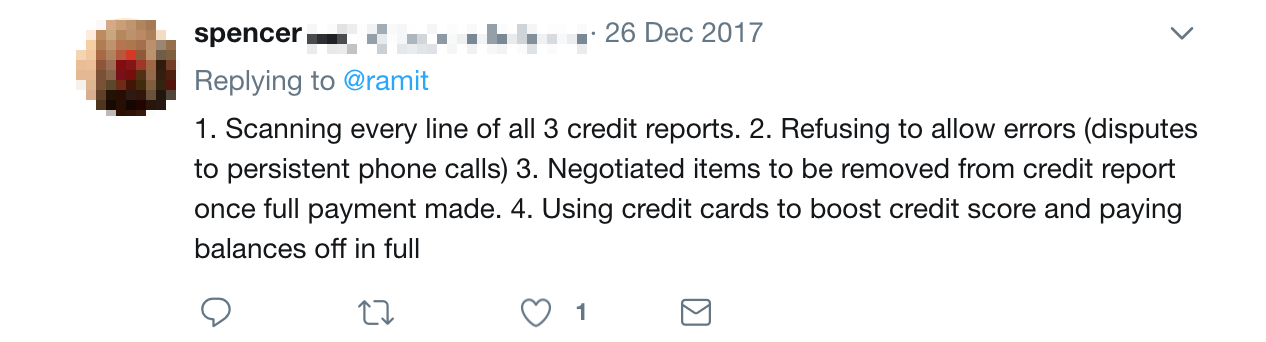

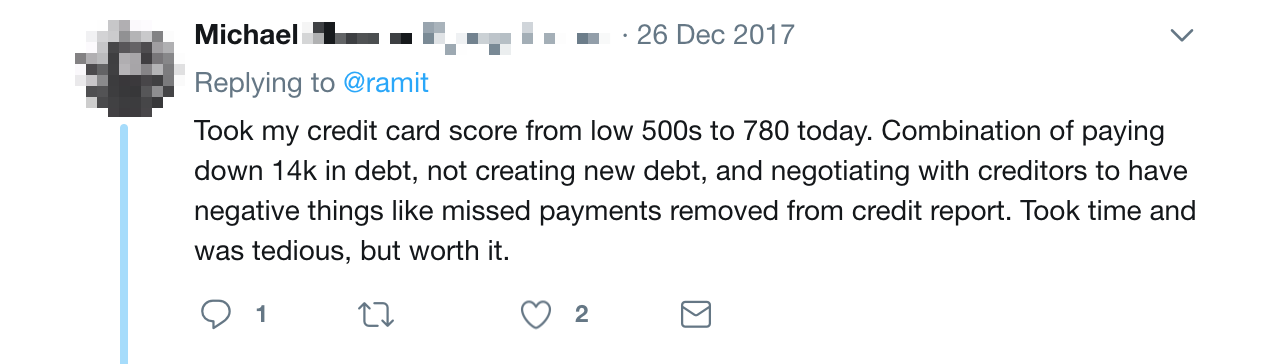

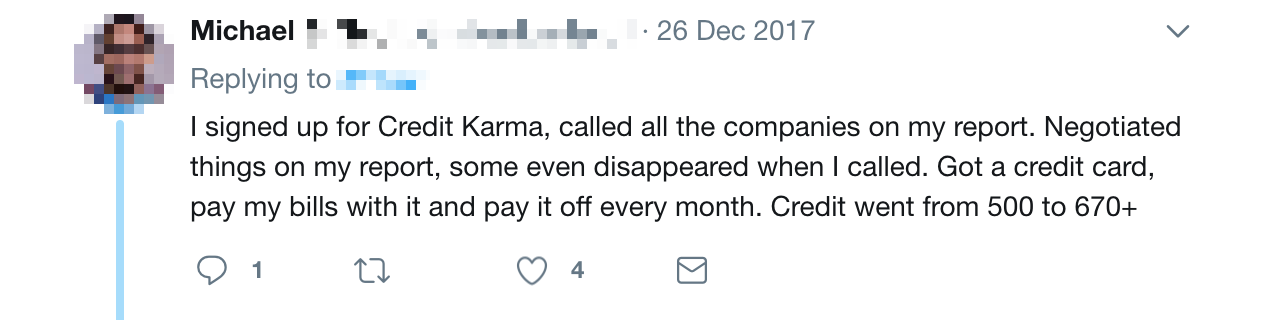

A while back I asked my readers how they improved their credit scores — and I got one common answer back: By disputing errors on their credit report.

“Took my credit card score from the low 500s to 780.”

“Credit went from 500 to 670+.”

These are great examples of BIG Wins — the big financial accomplishments where once you nail them, you don’t have to worry about minutiae like cutting out lattes or saving every penny you come across.

And you can work towards getting this Big Win in just five steps.

Step 1: Attain your credit report

A credit report is a comprehensive statement of your credit history. It includes information like:

- Opened and closed credit card accounts

- Current credit balance

- Debt owed

- Dates for when you’ve paid your debts

Credit reports are primarily provided by three major credit bureaus. They are:

Drawing upon information they receive from data furnishers and creditors, these credit bureaus work to provide you with an accurate credit history … but sometimes they get it wrong. So how often should you check your credit report?

If you have a good credit score (700 or more), you can check your credit report once a year.

However, if you’re saddled with a bad score (less than 700), you’ll want to check your credit report in order to dispute any errors.

Every American is entitled to a yearly free credit report from each major credit bureau. Head to AnnualCreditReport.com (a site recommended by the Federal Trade Commission) to get it.

If you already got your credit reports for the year, you can still get one. You’ll just have to pay a fee to the credit bureau you want to get it from.

BONUS: Check out this quick video I made a while back explaining how you can check your credit score and get your credit report.

Once you receive your report, it’s now time to find any and all errors that might be in there.

Step 2: Spot the errors

Errors are anything and everything that is wrong with your credit report. Finding them is crucial to making sure that your credit score is the best that it can be.

Here are just a few of the errors you might encounter:

- Identity issues. If your credit report mistook you for another person, or if they got your address wrong. Identity theft issues also fall into this category.

- Management errors. If you’ve already disputed an issue in your credit report but they show up again, this would be an example of a management error.

- Wrong account status. If your credit report states that you have accounts that are opened but you’ve closed them already (or vice versa).

- Wrong balance. If your credit report says you have the wrong balance for an account.

For a more comprehensive list, check out the Consumer Financial Protection Bureau list of the most common errors.

Go through your credit report line by line and note any mistakes that show up. I suggest printing out a copy and making notes with a pen or highlighter. That way you can send the credit report in with your dispute.

Once you’ve done that, it’s time to use a script.

Step 3: Craft your credit dispute letter

Here’s a handy template you can use for your credit report dispute letter:

Hello,

I want to dispute the following information in my file. The items I dispute also are encircled on the attached copy of the report I received.

- X is wrong because Y. I have attached a receipt showing this.

- A is wrong because B. On December 21st, I sent an email (“Correct my record”) requesting the change.

- C is wrong because D.

I have also included my payment records. Please make sure that these errors are rectified soon.

-Ramit

Nothing too flashy. Just get to the point and give them a comprehensive list of the errors you’ve found. Be sure to include a copy of your report as well.

Keep a copy of the report. That way, if there’s an error in a future report, you can use it to dispute the error.

Step 4: Send in the report

You have three options for where you can now send your credit dispute letter:

- The credit bureau

- The data furnisher

- Both

Guess which one will increase your chances of having the dispute work?

You guessed it! The answer is both.

Here are the links to exactly where you can send your dispute for specific credit bureaus.

- Experian: https://www.experian.com/disputes/main.html

- Equifax: https://www.equifax.com/personal/disputes/

- TransUnion: https://www.transunion.com/credit-disputes/dispute-your-credit

If you want to send your credit report dispute letter to a data furnisher, you’re going to have to handle that yourself since it’s specific to you and your financial situation.

Step 5: Analyze the results

The Consumer Financial Protection Bureau requires credit bureaus and data furnishers to “investigate the dispute within 30 days of receiving it.” After completing the investigation, they have five days to send you the results.

Once the investigation period is up, though, congrats! You’ve successfully disputed with the credit bureaus using a great credit report dispute letter!

You’ll now receive a few things. First, you’re going to get a complete summary on what the credit bureau discovered and the actions they decided to take to rectify the errors.

If they decided that what was in the previous credit report was correct, then they’ll tell you that as well.

The credit bureau will also send you a brand new updated copy of your credit report (Note: This is NOT your annual free credit report) and you can frame it and put it on your office wall so you can let everyone know how much of a weirdo you are. I like to put them on my mantle like hunting trophies.

That’s not the only credit dispute you can do, though — which brings us to …

Credit dispute system #2: Credit card charge errors

I remember I had to deal with a phone company trying to erroneously charge me $160 a while back. Rather than shrug my shoulders and say, “Eh it happens,” I decided to call in the big guns: My credit card company.

Little known fact: Your credit card company will do everything short of going to actual war for you when it comes to consumer protection. That’s why I always encourage people to make big purchases using their credit card.

When I called my company to dispute the charge, they asked me for my address, the amount I was charged, and the situation that occurred with the phone company. They immediately gave me temporary credit for the amount and told me to file a complaint — which I did.

Two weeks later, the situation was completely resolved in my favor.

Moral of the story: Your credit card company is on your side when it comes to disputes. In fact, the credit card company fights the merchant for you.

Follow these three steps and you can leverage your personal credit card army to help you fight erroneous charges.

Step 1: Gather all relevant information to dispute the credit card charge

Your greatest asset in credit disputes is information.

That’s why you’re going to want to gather all information you have regarding your dispute before you pick up the phone to call your credit card company. This will help you provide context and support your case.

Relevant information could include:

- Receipts

- Bank statements

- Credit card statements

- Emails

- Phone calls

Pro tip: Record every call you have with the offending company onto a spreadsheet. This will include details such as the last time you called, whom you spoke with, and what was resolved.

Here’s a great template you can work from.

You can download the tracker here.

Being able to cite a rep’s name, date, and call notes is incredibly powerful. Most businesses will take you seriously if you show them that you didn’t come to play.

Once you have all your information at the ready, it’s time to …

Step 2: Contact your credit card company

Now it’s time to actually call your credit card army to help with your credit dispute. Here is a list of phone numbers from the major credit card issuers you can use to dispute the charge:

- Visa: 1-800-847-2911

- American Express: 1-800-528-4800

- MasterCard: 1-800-307-7309

- Discover: 1-801-902-3100

- Capital One: 1-800-227-4825

- Chase: 1-800-432-3117

When you have a credit card rep on the line, simply tell them, “I want to dispute a charge on my credit card statement,” and describe the situation using the information you gathered in the first step.

Your credit card company will begin investigating the matter and issue you temporary credit until their case is resolved.

Once they’ve (hopefully) found that you were in the right, they’ll issue something called a chargeback that will refund you the credit and charge the merchant what you originally paid.

If you want to email your credit card company, here’s a great script you can use to contact them, straight from the FTC.

Dear Sir or Madam:

I am writing to dispute a billing error in the amount of [ $______] on my account. The amount is inaccurate because [describe the problem]. I am requesting that the error be corrected, that any finance and other charges related to the disputed amount be credited as well, and that I receive an accurate statement.

Enclosed are copies of [use this sentence to describe any information you are enclosing, like sales slips or payment records] supporting my position. Please investigate this matter and correct the billing error as soon as possible.

Sincerely,

[Your name]

REMEMBER: You need to do this within 60 days of the charge appearing on your bill. Once they receive the complaint, they’re legally required to respond to you within 30 days. The process will be roughly the same as when you talk to them on the phone — they’ll open up an investigation, issue you temporary credit, and either facilitate a chargeback or deny your complaint.

Step 3: Wait for the results

If your card was stolen or you find evidence of fraud on your card statement, your credit card company will cancel your credit card and issue you a new one as well as credit for any fraudulent charges.

No matter what happens … congrats! You now know how to dispute your credit card charges.

Master your credit today

To help you even more, I’d like to offer you something: The first chapter of my New York Times best-seller I Will Teach You to Be Rich.

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

Credit dispute: How to dispute any credit issue is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment