The perfect credit score is 850 — and it’s a lot easier to hit (or come pretty damn close to) that number than you think.

Trying to get a perfect credit score is also a great financial goal to have, right up there with:

- Getting out of debt

- Building an emergency fund

- Buying an endangered Bengal tiger (a la Mike Tyson)

Pictured: The (obscenely) Rich Life.

That’s why we talked to three people with perfect credit scores. They gave us their history, the credit cards they use, and what they’ve done to attain perfection.

Later, we’ll also give you a system on how YOU can get a great credit score.

- What is the perfect credit score?

- 3 lessons from the perfect credit score

- How to get a perfect credit score

- Get the first chapter of “I Will Teach You to Be Rich” for FREE

First, let’s take a look at what makes up your credit score — and why that matters.

What is the perfect credit score?

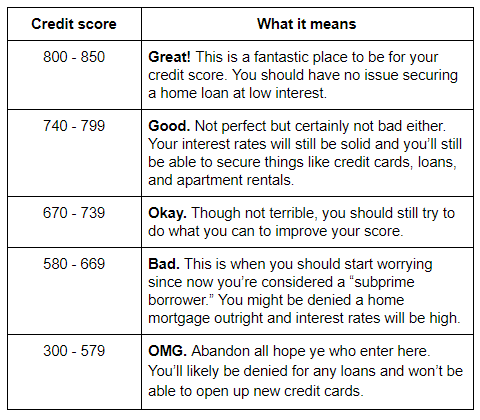

The perfect credit score is anywhere between 800 and 850.

That’s based on a range developed by a data company called FICO [Fair Isaac Corporation].

NOTE: There are other credit score ranges out there (one even goes as high as 900). But the most commonly used one is FICO.

Their scores are between 300 and 850. Your individual number is determined by information found on your credit report.

And there are three major credit bureaus that provide these reports (Equifax, Experian, and TransUnion). So you can have three different credit scores at any time. Granted, the scores won’t often differ that much from each other.

The following pieces of information determine your actual score (courtesy of Wells Fargo):

- 35% payment history. How reliable you are. Late payments hurt you.

- 30% amounts owed. How much you owe and how much credit you have available, or your “credit utilization rate.” And the formula for it is simple: (how much you owe) / (total credit available).

- 15% length of history. How long you’ve had credit. Older accounts are better because they show you’re reliable.

- 10% how many types of credit. If you have more lines of credit open, the better your score will be.

- 10% account inquiries. How many times you have or a lender has checked your credit background.

850 is technically the perfect credit score … but any score between 800 and 850 is often said to be “perfect” as well.

How? Take a look at the chart below:

Things like approval for loans and credit cards and interest rates won’t differ when your score is in the 800s.

Also, it’s very rare to get 850. In fact, only one in nine Americans has a credit score of 800 or higher. And just 1% have a credit score of 850 (Source: USA Today).

3 lessons from perfect credit scores

It’s not impossible though. You CAN attain a perfect credit score through surprisingly simple systems.

That’s why we talked to three people within this perfect credit score range and had them break down how they got their perfect credit scores.

Allow me to introduce you to them now:

Meet Randall, the finance teacher

Randall has a credit score of 842. He lives with his wife and toddler just southwest of Salt Lake City in the town of Herriman, Utah. There, he does God’s work as a high school finance teacher.

Meet Derek, the manager

Derek has a credit score of 829 but his credit used to be … well, less than perfect. “I used to think that credit cards were a sucker’s bet,” he explains. “So I paid bills using checks or auto-debit. While my credit score didn’t look terrible, I had essentially no credit history apart from utility bills and a couple bank accounts.”

This all changed one day when he needed to buy a car. “I needed to get a car loan of a pretty modest amount,” he says. “NOPE, not without a crazy interest rate. My score wasn’t bad, but the lack of history was a serious problem. So I applied for a decent credit card, just to see where the floor was. That was declined. At that point I started reading up on how to build up great credit.”

Meet Harry, the product marketer

Harry has a credit score of 830. He got his start building credit early in high school when his parents put him on as an authorized user on their credit card.

“They told me something I’ll never forget,” he recalls. “‘Credit is a tool. Treat it like a loaded gun.’”

After speaking with the three of them, I’ve distilled their insights into three lessons to help anyone improve their credit score:

Perfect credit score lesson #1: Start small and scale

Randall, the teacher:

“I got a credit card when I turned 18 and didn’t know exactly what I was doing with it. My parents both filed bankruptcy twice so I learned exactly what NOT to do from them.

“Then in college, I turned into a dollar-to-dollar Excel spreadsheet kind of guy … I have my whole personal finance system automated to pay off my card each month and I keep my accounts active — even the card I had when I was 18. Then one day, I realized I had a credit score in the 800s.”

Derek, the manager:

“I went to my bank and got a secured credit card of $500. Then I had it auto-pay out of my checking account. I paid all bills on time, no exceptions.

“I also set an alert to remind me every six months to request an increase on my spending limits on my credit cards. Once I had over $100k in available credit, my utilization was always rated ‘Excellent’ on my credit monitoring app so I stopped worrying about it.”

Harry, the marketer:

“When I went from 20 accounts opened in my lifetime to 22, that was the magic number that pushed me over the edge to have a near-perfect score. I think it also helped that I started building credit in high school when my parents made me an authorized user.”

Perfect credit score lesson #2: Be boringly consistent

Randall, the teacher:

“I mean this in the nicest way possible: If you just don’t be a dumbass, your credit is going to be great. Don’t buy shit you don’t need and pay your bills, then you’ll have a good credit score. That’s what I did and I got a great credit score because of it.”

Harry, the marketer:

“If you do the basic stuff — automated finances, getting and building credit each month — you’ll have to wait a few years but it will eventually work out. For me, I don’t even care about what my credit score is. I don’t care at all. Right now, I’m focused on work, and my family, and everything else. The credit score doesn’t even come up on my radar when I do my financial planning.”

Perfect credit score lesson #3: Focus on the 80/20

Randall, the teacher:

“Pay off at least some of your statement each month. Don’t get me wrong. You should do all you can to pay your credit card statement in full. But if you don’t have enough money for one reason or another, you should still pay a small amount. Some payment is better than nothing when it comes to your credit score.”

Derek, the manager:

“Implement a schedule for everything. This takes a while. Bills have to be paid, credit needs to be increased, etc. I set recurring reminders on my smartphone and implement autopay.”

Harry, the marketer:

“As long as you’re making automated payments each month and you have a low credit utilization ratio, none of the rest really matters.”

How to get a perfect credit score

What do you notice about our three perfect credit score holders’ answers?

A perfect credit score takes time. You won’t get it right away — especially if you’re just starting to build credit.

Like Harry said, though, this is all 80/20. The small amount of work you put in now will pay off in spades later.

And you don’t need to do anything crazy either. In fact, here are four steps that’ll help you move the needle on your credit score:

- Get rid of your debt

- Hold onto your cards

- Decrease your credit utilization rate

- Automate your finances

Step 1: Get rid of your debt

Debt is one of the BIGGEST barriers preventing people from living a Rich Life. That’s why if you want to be able to start focusing more of your energy on earning more money and investing, you need to delete your debt.

For Ramit’s full system on getting out of debt for good, check out our article on the five steps to get out of debt fast.

If you want even more insights on getting out of debt, check out Ramit’s old video on negotiating your debt.

Step 2: Hold onto your cards

You’ll notice some of our perfect credit score holders above have held onto cards for decades. That’s because 15% of your credit score is determined by your credit history.

If you close a credit card account, you’re also closing that credit history.

The amount of credit cards you have open also affects your credit utilization rate — which is VERY important to attaining a perfect credit score.

There will be times when you need to close a credit card for one reason or another. But know that your score is going to take a hit while it readjusts to your new credit history.

Pro tip: If you’re planning on applying for major loans (car, home, etc.), don’t close a credit card within six months of it. You want as much credit as possible for those situations.

So keep your cards open and put a recurring charge on the ones you don’t use that often. This shows that your card is active and keeps your credit history healthy.

Step 3: Decrease your credit utilization rate

Your credit utilization rate impacts 30% of your credit score since it impacts the amount you owe.

And the formula for it is simple:

Unlike your credit score, the lower THIS number is, the better.

Let’s look at an example: If you carry $1,000 debt across two credit cards with $2,500 credit limits each, your credit utilization rate is 20% ($1,000 debt / $5,000 total credit available).

If you close one of the cards, suddenly your credit utilization rate jumps to 40% ($1,000 / $2,500). But if you paid off $500 in debt, your utilization rate would be 20% ($500 / $2,500) and your score would not change.

When your credit utilization rate is low, it shows lenders that you don’t typically spend all the money you have available in your credit — which means you likely won’t default and they won’t lose money.

You can improve your credit utilization in two ways:

- Don’t carry a lot of debt on your credit cards.

- Increase the amount of credit available to you.

We’ve already hit the first part — so let’s take a look at a script to help you negotiate your credit limit with your card company:

YOU: Hi, I’d like to request a credit increase. I currently have $5,000 available and I’d like $10,000.

CC REP: Uh … why?

YOU: I’ve been paying my bill in full for the last 18 months and I have some upcoming purchases. I’d like a credit limit of $10,000. Can you approve my request?

CC REP: Okay. I’ve put in a request for an increase. It should be activated in about seven days. Anything else I can do for you?

Ramit suggests requesting a credit limit increase every six to 12 months. Only do this if/when you’re out of debt though.

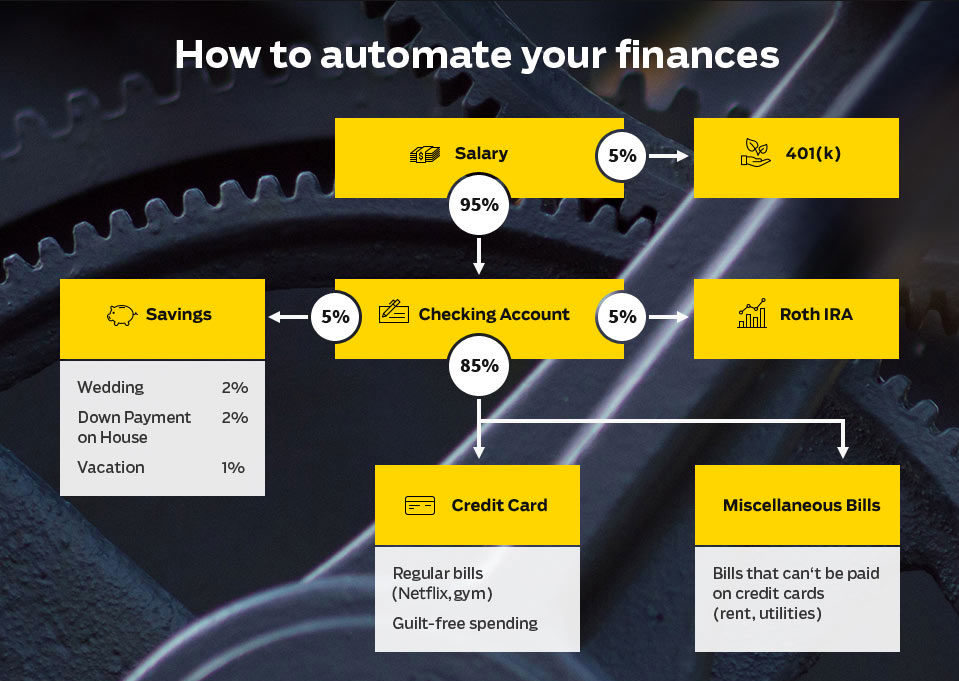

Step 4: Automate your finances

This is IWT’s proven system that:

- Gets you out of debt

- Helps you save for anything

- Earns you money

The best part? You do all of this passively. That means there’s no hassle of moving your money around, and no pain from seeing your money part from you.

And since 35% of your credit score is determined by your payment history, it’s important to automate your system so you pay your bill on time and in full each month.

For more information on how to automate your finances, check out Ramit’s 12-minute video where he goes through the exact process with you.

You should ideally be paying off your entire credit card balance each month, but if you can’t, you can still improve your score by paying at least the minimums, on time, every month.

Get the first chapter of “I Will Teach You to Be Rich” for FREE

Take the time to start improving your credit score using the four systems outlined above — and to help you even more, I’d like to offer you something: The first chapter of Ramit’s New York Times best-seller “I Will Teach You to Be Rich.”

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

Perfect credit score: 4 steps to 850 is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment