I’m a big fan of online banking services or credit unions over Big Banks (e.g., Bank of America, Wells Fargo, the banks that Satan uses). Avoiding the big guys typically gives you access to the best checking accounts with great rewards and almost no downsides.

Most importantly: online banks and credit unions don’t try to nickel-and-dime you with fee after fee.

I’ve studied most of the checking accounts on the market, and today, I’ll show you the best one I’ve found. In fact, it’s the one I use as my primary checking account.

- THE BEST CHECKING ACCOUNT: Charles Schwab Investor Checking

- Honorable mentions

- 3 things to look for in checking accounts

- 5 ways banks try to trick you

- Automate your checking accounts

Charles Schwab Investor Checking: The best checking account

Most people think of Charles Schwab as a bank solely focused on investments. But they also offer what I believe to be the best checking account available. Why?

- No fees

- No minimums

- No-fee overdraft protection

- Free checks

- Deposit checks via pre-paid envelopes or via iPhone app (snap photos of your check — no need to go into branch)

- An ATM card

- BEST BENEFIT: Unlimited reimbursement of any ATM usage

This last point is what puts Schwab over the top. How often do you go out with friends and have to withdraw money from out-of-network ATMs? How often do you find yourself at a cash-only taco place at 3:30am, needing to withdraw $280, but you hesitate because of onerous ATM fees?

Me too.

Those fees can add up, and Schwab reimburses you for all of them. If you rack up $200 worth of ATM fees in a month, you’ll see a $200 deposit from Schwab before the month ends. This means you can use ANY ATM — corner stores, other banks, whatever — without having to look for some specific bank’s ATM.

Some people will balk at using Schwab because it’s an online bank. That’s fine, but I urge you to reconsider: It’s rare to find a checking account that (1) avoids screwing you at every turn, and (2) actually rewards you for using them.

You know by now that I’m all about Big Wins. This perk alone can result in hundreds of dollars a year that you do nothing to redeem. The ATM-fee reimbursement for the rest of your life is enough of a benefit, but stack on the trust Schwab has built with me, and I’m a long-term customer.

How to open a Charles Schwab checking account

To get started with the Schwab Checking Account, click here. Note: It’s not an affiliate link. I have no relationship with Schwab except being a happy customer.

To learn how to fully automate your finances — including ultra-specific recommendations on accounts, investing, debt, negotiation, money & relationships, and buying a car/house — pick up a copy of my book, on sale for less than $10.

Honorable mentions

I LOVE my Charles Schwab checking account. I think it’s the best checking account out there — but I also know there are a ton of other great ones out there too.

Here my other three suggestions for fantastic checking accounts:

Your local credit union

Credit unions are like local banks, but they’re not-for-profit and are owned by their customers (or, in credit union parlance, “members”).

As a result, credit unions usually provide better loan rates and more personalized service than other brick-and-mortar banks. So I’m a BIG fan of them.

Most will allow you to establish a checking account, savings account, or loan, although some require membership in associations like any other unions.

Full disclosure: I’ve spoken at a number of their national conferences to help them understand how to reach young people, which I loved doing because I hope they succeed in reaching out to other twentysomethings.

To find a credit union near you go to this link and enter in your information.

Capital One 360 Checking

Long-time readers know that I was a HUGE fan of ING Direct Electric Orange account before they merged with Capital One and became Capital One 360.

While a lot of people were worried (i.e., freaking terrified) that Capital One would get rid of all of the things we loved about ING Direct, the checking account is still actually a pretty good deal.

A few things I LOVE about this account:

- No fees

- No minimum

- Free ATM access to over 38,000 Capital One ATMs

- Automatic overdraft protection

The only reason I don’t use this account for checking is because it doesn’t offer free ATM withdrawals (like Charles Schwab checking). Still a fantastic option though.

Ally Interest Checking

Another checking account I love is Ally Interest Checking. Ally is an online bank, meaning there are no physical locations, eliminating overhead and allowing them to offer dramatically higher interest rates than traditional Big Banks.

A few reasons Ally is great:

- No monthly fee

- No minimum

- 24/7 banking staff

- Access to over 43,000 ATMs

- 0.10% APY (That goes up to 0.60% if you have at least $15,000 balance)

- Up to $10 in ATM fees reimbursed per statement cycle

Ally is an all-around fantastic online bank.

“The Inbox:” Why you need the best checking account

Choosing a checking account that works for you is crucial because it’s at the center of your personal finances.

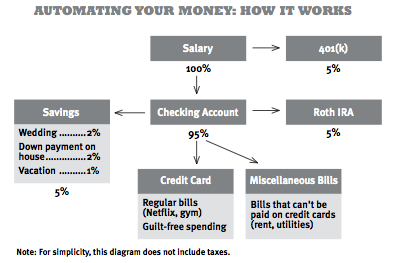

I write often about building an automated personal finance infrastructure — a system that funnels your money to where it needs to go on a schedule, with minimal involvement from you.

This way, the money left over after bills is yours to spend guilt-free. Chapter five of my book is all about how this system works and how to build your own.

Of all the components in that system, none are more crucial than your checking account. As I wrote in the book:

“I think of my checking account like an e-mail inbox: all my money goes in my checking account, and then I regularly filter it out to appropriate accounts, like savings and investing, using automatic transfers.”

Your checking account is the center of it all, the nexus of your bulletproof personal finance system. Unfortunately, as I also point out in the book, checking accounts are the number one place where unnecessary fees are levied.

That’s why I want to go into what exactly you should be looking for when searching for checking accounts — even if you DO choose the ones I recommended above.

3 things to look for in checking accounts

I look for three things when it comes to deciding whether or not a bank has a good checking account: trust, convenience, and features.

1. Trust

For years, I had a Wells Fargo account because their ATMs are convenient, but I don’t trust Big Banks anymore.

I’m not the only one. At the moment, Big Banks are looking around wildly, wondering why young people like me are moving to high-interest accounts online.

Perhaps it’s because they secretly insert fees, like the filthy double charges for using another ATM, then count on our inaction to make money off us.

Perhaps it’s because they like to nickel-and-dime you every step of the way.

Perhaps it’s because they’re evil incarnate, forged in the hell fires of damnation where mercy, hope, and happiness doth not shine—

Okay. I MIGHT have a bit of a chip on my shoulder when it comes to Big Banks.

There are still some good banks out there, though. The best way to find one is to ask friends if they have a bank they love.

Your bank shouldn’t nickel-and-dime you through minimums and fees. It should have a website with clear descriptions of different services, an easy setup process, and 24/7 customer service available by phone.

Another thing: Ask them if they send you promotional material every damn week. I don’t want more junk mail! Stop sending crap! A couple of years ago, I switched my car insurance because they would not stop sending me mail three times a week. Go to hell, 21st Century Insurance.

2. Convenience

If your bank isn’t convenient, it doesn’t matter how much interest you’re earning — you’re not going to use it.

Browse the bank’s website. See what features they have.

Since a bank is the first line of defense in managing your money, it needs to be easy to put money in, get money out, and transfer money around. This means its website has to work, and you need to be able to get help when you need it — whether by e-mail or phone.

3. Features

The bank’s interest rate should be competitive. If it’s an online bank, it should offer value-added services like prepaid envelopes for depositing money and convenient customer service. Transferring money around should be easy and free because you’ll be doing a lot of it, and you should have free bill paying. It’s nice if the bank lets you categorize your spending and get images of canceled checks, but these aren’t necessary.

5 ways banks try to trick you

While you’re searching around, also keep an eye out for ways a bank is trying to trick you.

Banks LOVE to pull scammy marketing tricks to get you to buy into their services. Luckily I’m here to show you exactly what they’ll try to do — and how you can avoid it.

- Teaser rates like “6% for the first two months!” Your first two months don’t matter. You want to pick a good bank that you can stick with for years — one that offers overall great service, not a promo rate that will earn you only $25 (or, more likely, $3). Banks that offer teaser rates are, by definition, to be avoided.

- Requiring minimum balances to get “free” services like checking and bill paying.

- Up-sells to expensive accounts (“Expedited customer service! Wow!”). Most of these “value-added accounts” are designed to charge you for worthless services.

- Holding out by telling you that the no-fee, no-minimum accounts aren’t available anymore. They are. Banks will resist giving you a no-fee, no-minimum account at first, but if you’re firm, they’ll give you the account you want. If they don’t, threaten to go to another bank. If they still don’t, walk out and find one that will. There are many, many choices and it’s a buyer’s market.

- Bundling a credit card with your bank account. If you didn’t walk in specifically wanting the bank credit card, don’t get it.

By recognizing these tricks, you’ll be able to find a checking account that works for you while avoiding all the scams.

Automate your checking account

Want to learn the system I use to get more out of my checking account — and spend just minutes a week on your finances?

I have the perfect system for you:

I mentioned it above — but if you don’t know what it is, prepare to be blown away at how effortless saving and investing can be.

I’ve created a 12-minute video showing you exactly how this system works. Just enter your information below and receive it in your inbox for FREE.

The 4 best checking accounts to open today is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment