You know what would be great? If we could always be ready for the unexpected.

Like, say, dropping a comically oversized bottle of champagne worth thousands of dollars like this dude.

Here’s a system that can help you prepare for even the worst emergencies WHILE allowing you to save for awesome purchases in the future:

Sub-savings accounts are fantastic for setting concrete savings goals for any purchase you might want to make in the future.

I’m talking about big purchases like weddings, engagement rings, homes, and even emergencies and dumb mistakes like when I got hit with this late registration fee for my car awhile back.

Now I put away $150 / month in a sub-savings account for unexpected expenses like this one.

Let’s break down what it is, where you can get one, and how you can set one up today.

What is a sub-savings account?

A sub-savings account is an account you create to save for specific purchases or events.

Using my automated personal finance system, I use monthly automatic transfers to funnel money into each of my sub-accounts. Now that these transfers are in place, I’m getting closer to each of my goals automatically, month after month, without having to remember to set money aside.

This is precisely how people accomplish financial goals passively. Because when you don’t see the money — when it’s automatically withdrawn from your checking account and shunted to specific savings goals — you will never miss it. However, a few months later, you’ll be amazed at how quickly you’re progressing to your targets.

How to set up a sub-savings account

You need to first have a regular savings account that allows you to set up sub-savings if you want to set up your own.

If you already have a savings account, chances are your bank already does this. If this is the case, head to step two.

If you don’t have a savings account that allows sub-savings (or if you don’t have one at all), that’s okay! You simply need to open one up.

Here are a few great suggestions for banks that offer great savings accounts (with sub-savings):

- Capital One 360 / ING Direct (This is the one I use)

- Ally Bank

- Barclays Online

- Discover Online Savings

I use Capital One 360 (formerly ING Direct). I praised this bank account in my New York Times best-selling book I Will Teach You To Be Rich over 10 years ago and I STILL use the same account now.

A few fast facts about the Capital One 360 savings account:

- No fees

- No minimums

- High-yield interest rate at 1% APY

- Links to your checking account (even if not in ING) via electronic transfer

Which savings account you choose doesn’t matter as much as just getting started. So don’t spend too much time deciding which one to go with. They’re all great.

Once you have your savings account set up, it’s time to start saving with your sub-account.

Step 1: Set a sub-savings account savings goal

This is the fun part — you need to come up with goals for your sub-savings account.

You’ll have something concrete to work towards when you create goals — that way you’re not just throwing money mindlessly into a large savings account.

When I first discovered sub-savings accounts, I created one and named it “Down Payment” for a down payment on a house. I was regularly transferring money into it based on my savings goals using my automated finances.

As the months passed, and the amount in that account grew, I felt really proud of my accomplishment.

During this time, one of my friends was just blindly putting away money in an account he had mentally earmarked for vague goals.

Though we might have had the same amount saved away, the difference between us psychologically was staggering. Where he felt despair about trying to save money, I was motivated.

For me, I wasn’t working towards $20,000 for a down payment. I was working on saving $333 a month over five years — a perfectly achievable goal, especially after I tracked my progress.

Eventually, my friend did open up his own sub-savings account. He told me that doing so changed his entire perspective on saving money for the better.

So think of things YOU want to save for.

Here are a few suggestions:

- Wedding / engagement ring

- Down payment on home

- New car

- Emergency payments (car breaks down, surprise medical expenses, etc.)

- Travel / vacations

Once you have a goal in mind, it’s time to get really specific with it — and you can do that with SMART Objectives.

SMART stands for specific, measurable, attainable, relevant, and time-oriented.

A good goal will exemplify all those things.

Check out these examples of how normal goals compare to SMART Objectives:

–

BAD GOAL: I want a house.

SMART OBJECTIVE: I will put $XXX dollars into a sub-savings account each month until I have enough for a down payment on a house.

–

BAD GOAL: I want to travel.

SMART OBJECTIVE: I will read Ramit’s article on “How to travel cheaply,” pick a destination, price it out, and learn how I can travel on a budget this July.

–

So think:

- Is there something you’re saving for?

- When do you want it by?

- How much can you save each month?

- How will you know you’re on the right track?

Saving with a goal in mind puts all your decisions in focus.

Step 2: Create the sub-savings account

Now it’s time to actually create the account.

Though the exact steps will vary from bank to bank, the process is essentially the same for each savings account: Go to your bank’s website, log in to your account, and create a new sub-savings account.

Chances are your bank will even allow you to give the account a nickname. This lets your sub-savings accounts reflect your savings goals, like I did with my down payment.

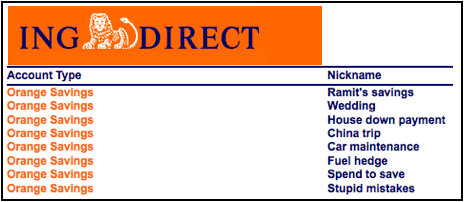

Check out all the different sub-savings accounts I had in my old savings account.

ING Direct is now Capital One 360. BTW that wedding one is going to be put to good use.

Here’s a look at a few sub-savings accounts I have now:

ING switched to Capital One 360, and I used the money I saved to buy an engagement ring

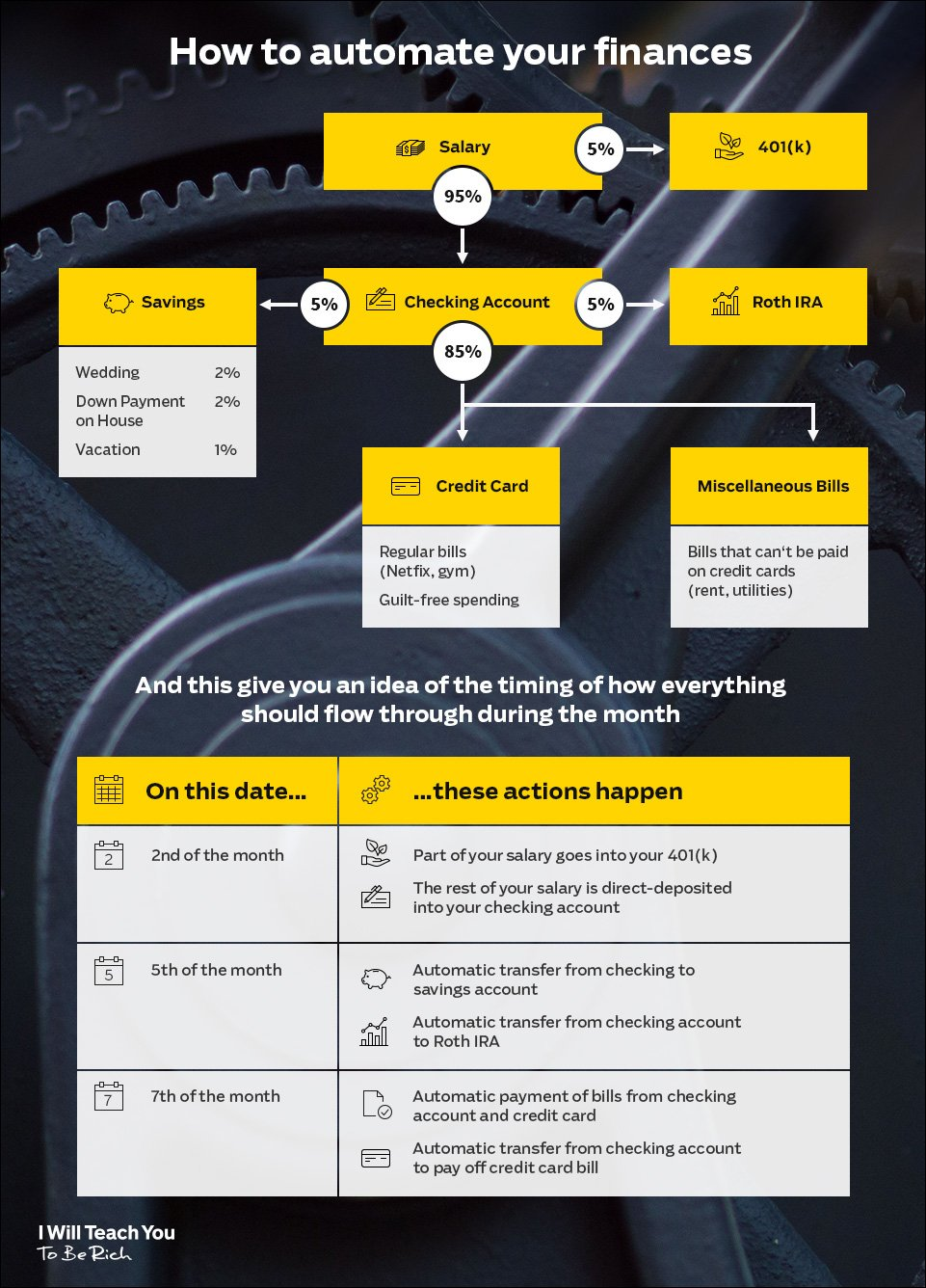

Step 3: Automate your sub-savings account

Once you have your sub-savings accounts open, it’s time to automate the entire system.

Automated finances are the ultimate cure to never knowing how much you have in your checking account and how much you can spend.

When you receive your paycheck, your money is funneled to exactly where it needs to go — whether that be your utilities, rent, Roth IRA, 401k, or your savings account.

Check out my video below to learn exactly how to set it up today.

Earn money for your sub-savings account

I suggest putting around 5% of your income into your sub-savings account each month. Though this amount seems small, you’re going to be surprised at how easily it will add up over time.

The best way to make that 5% even bigger is by earning more.

I’ve said it once and I’ll say it a thousand more times: There’s a limit to how much you can save but no limit to how much you can earn.

That’s why my team and I have worked hard to create a guide to help you earn more today:

In it, I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own business and escape the 9-to-5 for good.

- Increase your income by thousands of dollars a year through side hustles like freelancing.

Download a FREE copy of the Ultimate Guide today by entering your name and email below — and start blowing up your net worth today.

Sub-savings accounts: How to save for anything in 3 steps is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment