Real estate investing can be a great way to make a lot of money if you do your research and are prepared to devote a lot of time to your investments.

However, it’s also a great way for investors to lose money. I believe that real estate is one of the most overrated investments in America, and very few will show you real numbers to explain why.

That’s why I want to break down the facets of real estate investing, show you a few ways you can get started (if you want to), and reveal the myths behind real estate that you won’t hear anywhere else.

- Real estate investing: 3 ways to do it

- 4 real estate investing myths

- When you should actually buy a house

- What you should be investing in

Let’s get started.

Real estate investing: 3 ways to do it

Here are three ways you can approach real estate investing:

- Investing in a REIT

- Buying a rental property

- Flipping properties

Some ways are better than others depending on your financial situation and goals. While I’m not a fan of real estate investing, I do believe that if you’re going to do it, you should understand your options.

Real estate investing #1: A REIT

REITs, or real estate investment trusts, are a good choice if you want to get involved with real estate investing but don’t want to make the huge commitment of purchasing a property.

That’s because REITs are like the mutual funds of real estate. They’re a collection of properties operated by a company (aka a trust) that leverages money from individual investors to buy and develop real estate. And investors get paid in dividends with REITs just like any other fund. And you, too, can be one of those individual investors.

REITs can focus on a variety of different industries both domestically and internationally, and you can invest in REITs that invest in apartments, business buildings, or even healthcare facilities.

In all, they are an easy and straightforward way to get involved with real estate investing without having to put up an enormous upfront cost of actually buying property. To get started, you just have to go to your online broker and purchase a REIT like you would your typical investments.

If you don’t know how to do that, that’s okay! Check out our article on mutual funds to find out exactly how you can open one.

But let’s say that you have $30,000+ just burning a hole in your pocket. If you’re willing to make a much riskier foray into real estate investing, you can take the next two strategies.

Real estate investing #2: Rent out properties

Renting out property seems simple enough:

- Buy a house or apartment building.

- Rent out the rooms to tenants for a nominal fee.

- The rental checks come in like gangbusters each month while you sit on a beach in Cabo sipping pina coladas and making passive income.

Hell, that DOES sound awesome — but it’s also complete oversimplification. In fact, renting out property is anything but relaxing. That’s because you’re responsible for all facets of the building you’re renting out as the owner. That includes repairs, maintenance, and chasing down tenants who don’t pay your rent.

And god help you if they do miss a rent payment. If that happens, you’ll have to find another way to pay your monthly mortgage payment.

You CAN make money from renting out properties (many people do!). It’s just that doing so can negatively affect your finances in a BIG way. Check out our house poor article for a good example of that.

If you’re interested in purchasing properties to rent out, be sure to check out the seven-part series on real estate investment basics by Owen Johnson (more on this later). You can find the first article here.

Real estate investing #3: Flipping properties

So you were on your seventh episode of your Fixer Upper binge-watch session and it occurred to you, “Hey, I can do this too!”

By purchasing a house or other piece of property and then renovating and selling it (i.e., “flipping” a property), you can flex your creative and business muscle at the same time…

…but it’s also harder than launching your car into space.

Unless you’re Elon Musk, I guess.

Not only do you have to have the money to buy the property but you also need to be incredibly accurate in terms of the finances that go into the renovations you want to put into the home if you want to make a profit.

That includes things like finding a contractor, estimating the cost of repairs/renovations, and being willing to take the dip in your finances while you try to find a buyer. After all, the longer you hold on to the property, the more you lose in mortgage payments.

But who knows? You might land your own HGTV show and get to do weird things while flipping houses, like this guy:

BONUS: How to buy a house — real estate investing basics

If you’re really prepared to put in the time to learn about real estate and make sound decisions, check out this seven-part series on real estate investment basics by my friend Owen Johnson. It’ll help you reap the rewards if you decide you’re cut out for it.

Of course, this is just the beginning. I suggest you have intermediate knowledge of real estate before you make your purchase.

- The Real Scoop on Real Estate

- Starting Down the Real Estate Investment Path

- The Transaction Mechanics

- A Primer on Real Estate Agency

- Leveraging Yourself to Grow Your Wealth

- Management Infrastructure

- Real Estate Basics – In Review

4 real estate investing myths

I’ll be honest though: I think many people who invest in real estate are making a bad investment. It’s only exacerbated by all of the BS out there about owning a house.

Think about it. We’ve all thought about buying a four-bedroom house and a white picket fence on our own slice of the American Dream .

.

What many don’t realize, though, is that investing in the four-bedroom house can quickly turn into the biggest money and time sink of their lives. In fact, buying a house is just another one of those invisible scripts that we blindly follow without giving it a second thought.

Invisible scripts are those guiding beliefs that are so deeply embedded in our day-to-day lives that we don’t even realize they’re there.

We’ve all heard them before:

- You need to make sure you get a college degree

- After you graduate, you need to get married

- After you get married, you need to have kids

And buying a house is one of those scripts — despite the fact that it’s one of the biggest, life-altering decisions you can make.

In fact, I receive emails every day from people saying, “I have a horrible financial problem. Plz help!” and 40% of the time, it’s directly related to their mortgages.

In chapter 9 of my New York Times best-selling book, I’m hyper-critical of people buying real estate because they think it’s a “good investment” or because they think they’re “throwing money away on rent.”

Those myths — and many others — are just that. Myths. And they’ve been so detrimental to many people’s financial situations that I feel like I need to dispel some of them today.

Here are the four myths of real estate you need to know before you even think about buying a house.

Real estate investing myth #1: “Purchasing real estate is a great investment”

One thing I always hear from people who are about to buy a house is, “Buying real estate is an investment! One day this house is going to be worth WAY more than it is now.”

Look, I get it. We’re always hearing stories from old farts who bought their homes way back in the Truman administration for just $30,000 and now it’s worth $450,000 or whatever.

When the truth is the people who say things like this don’t account for the invisible factors like inflation and maintenance.

Yale economist and Nobel Laureate Robert Shiller reported that from 1890 to 1990, the return on residential real estate was just about ZERO after inflation.

Realtors and homeowners are going to flood my inbox with hate mail for saying this, but real estate is the most overrated investment in America. Even Warren Buffett, one of the world’s wealthiest men, points out that houses don’t necessarily increase in value. By the way, he’s still living in the same five-bedroom house he bought in Omaha, Nebraska, back in 1958.

James Altucher wrote about why entrepreneurs shouldn’t buy a home, and he suggests the following:

“Take 1/20th of the down payment amount. Start a business.

Your investment might go to zero (which it might also do with a house) but it might also go up to 10,000% returns.

Eventually, as an entrepreneur, if you are persistent enough, you will get one of those 10,000% returns. And you will be persistent because you didn’t waste all the money and time that a house would’ve cost you.”

Real estate investing myth #2: “I’m throwing away my money if I keep renting!”

A reader once told me, “Ramit, I pay $1,000/month renting my apartment, so I definitely can afford $1,000 a month on a mortgage and build equity!”

So I asked her, “Well, how nice is your apartment?”

She admitted that the hardwood floors were old and the kitchen was very outdated.

“So will you want a house like that,” I asked, “or will you want a nicer place — one with recessed ceilings, newer appliances, and a balcony large enough for entertaining?”

She looked at me as if I were an idiot. “Of course I want a nicer house.”

“Okay,” I replied. “But that will cost more than your current rent, right?”

When I said that, a lightbulb went off in her head. She hadn’t even considered that.

Chances are people who want to buy a house haven’t either. Of course, you’ll want a nicer house than the apartment you’re currently renting — ESPECIALLY if you’re committing yourself to a long-term investment like a mortgage. But that means your monthly payment will be higher.

Of course, that seems pretty obvious — but it’s only the beginning.

What many people often ignore when they say that they don’t want to throw money away on renting are the Phantom Costs.

Phantom Costs are things like:

- Property taxes

- Insurance

- Utilities (e.g., internet, electricity, gas, water, etc.)

- Home maintenance fees

- Toilet drains breaking randomly at 2 am forcing you to awkwardly ask your neighbor if you can use their bathroom before you spend a few hours Googling “24-hour plumbers”

These costs will add hundreds per month to your living expenses.

After all, you’re not just paying the mortgage each month. You’re also paying for the oven if it breaks down, or the hot water heater if it isn’t working, or that cockroach problem you inherited from the previous owner.

When you rent, you can just call your landlord if any of those things happen, and he or she foots the bill.

(By the way, the common response here is: “Landlords factor all of that into your rent. They wouldn’t rent out their place if they couldn’t make a profit!” This is incorrect. Landlords don’t charge what their cost is + a profit. Landlords charge what the market will bear. Some make a profit, but many of them are losing money each month.)

When you own, though, you have to fix those things or call someone else to fix them for you. And of course, that comes out of your own pocket.

Sure, the plumber here and the exterminator there doesn’t sound that bad … but imagine that in the course of owning a house, your roof breaks. All of a sudden, that’s $25,000 you need to invest in repairs.

So even if you have a mortgage that is the same as your rent — let’s say $1,000 — you still need to add 40-50% to that monthly amount to factor in the phantom costs. Now you’re paying closer to $1,500/month.

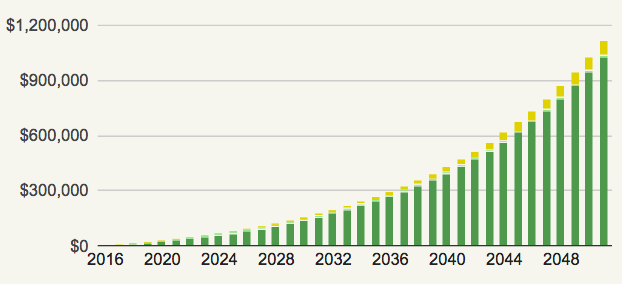

Check out this graph. It shows the true cost of buying a home over 30 years.

If you purchase a $300,000 house today, over 30 years, it could cost you almost $1 MILLION.

In the end, you’re not throwing your money away by renting — but you will throw your money away if you buy a house without knowing what you’re doing.

In the video below, I break down the myths of renting vs buying a house a bit more. Check it out.

Real estate investing myth #3: “If I cut back on enough avocado toast I can afford a house!”

Just… Stop it. Right now.

Real estate investing myth #4: “I can always leverage this house or take advantage of the tax savings”

This is effectively two myths in one — but they both boil down to one idea: People think they can guarantee that they will make money by investing in real estate.

I’m talking about leverage and tax savings, and BOTH can cause you to lose money.

- Leverage

So many homeowners point to leverage as a key benefit to their real estate investment.

For example, you can put $20,000 down for a $100,000 house, and if the house climbs to $120,000, you’ve effectively doubled your money.

That sounds great, but it’s ignoring one big thing: The price of a house doesn’t always increase (*cut to people who purchased a house in 2007 crying and nodding*). So unfortunately, leverage can work against you if the price goes down.

If your house declines by 10%, you don’t just lose 10% of your equity — it’s more like 20% once you factor in the 6% in realtor’s fees, closing costs, new furniture, and other expenses.

You need to be prepared to face this potential loss before you drop several hundred thousand dollars on a new house.

- Tax savings

People think that they can deduct their mortgage interest from their taxes and save a bunch of money.

Though you can deduct your mortgage interest, people forget that they’re saving money that they ordinarily would never have spent.

Think about it. The amount you pay out owning a house is much higher than you would for any rental when you include all those phantom payments I mentioned. So even though you’ll certainly save money on your mortgage interest through tax breaks, the net is usually a loss.

At the end of the day, both leverages and the tax breaks you get from buying a house just aren’t good enough reasons to justify investing in real estate.

So when IS a good time to buy a house?

When you should actually buy a house

Warning: This is going to get a little bit complicated.

To know exactly when the right time is to purchase a house involves a lot of analytics and hours slaving over spreadsheets and “A Beautiful Mind”–style chalkboard equations.

You ready? Here’s when you should actually buy a house:

The fact is there isn’t a right time that fits everyone. Your invisible script is going to tell you that you should buy a house after college or when you’re ready to start a family — when the truth is the right time is as different for you as it is for the next guy. And it may not even be for financial reasons.

Hell, there might not ever be a right time. And that’s okay too.

However, if you are genuinely interested in investing in real estate, I do suggest you do a LOT of research before you jump into anything.

Here are a few GREAT resources I recommend if you’re thinking about buying a house:

- The Bogleheads’ Guide to Investing: This is a great website filled with a lot of helpful advice regarding all things investing, including real estate. It’s inspired by the teachings and philosophies of Jack Bogle, the founder of Vanguard

- “In the Long Run, Sleep at Home and Invest in the Stock Market”: This is the seminal article from the New York Times on why we underestimate Phantom Costs like insurance, inflation, and taxes. Note the haunting story at the end

- Fixed rate vs adjustable rate: An article I wrote a while back examining why people still take the risky route when purchasing a house

In the end, purchasing real estate might be right for you and it might not. But do not make the largest decision of your financial life because it’s something you “should” do.

What you should invest in

In general, buying real estate is NOT a great investment for individuals.

Instead, I recommend conservatively investing in the stock market via index funds.

By investing in sensible, long-term investments, you’ll have a balanced portfolio that’ll earn you thousands well into your life.

And the sooner you start, the easier it is to get rich.

This isn’t BS either. There’s over 100 years of evidence in the stock market that suggests this.

Still don’t believe me? Let’s look at another real world example.

Say you’re 25 years old and you decide to invest $500/month in a low-cost, diversified index fund. If you do that until you’re 60, how much money do you think you’d have?

Take a look:

$1,116,612.89.

That’s right. You’d be a millionaire after only investing a few thousand dollars per year.

Notice, I’m not talking about the Hollywood type of investing where hotshot stock brokers make huge multimillion dollar trades while yelling “SELL” into a phone for some reason.

I said you should invest in low-cost, diversified index funds over time. That’s because smart investments are about consistency more than anything else — not chasing hot stocks. Or other weird investments:

Only through smart investments can you live a Rich Life.

And I want to help you get there. That’s why I’d like to offer you something that’ll help you turbocharge your investments:

This guide will help take out the pain of actively investing your money each month. I’ll walk you through the EXACT step-by-step process of setting up your automated finances. By the time you’re done, you’ll be saving AND earning more money passively.

Enter your information below and I’ll send you my free video straight to your inbox.

Real estate investing: The myths, facts, and ways to get started is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment