You can make expensive purchases without feeling guilty or judged. Let me show you a few examples.

To start, if you want to learn how to make any expensive purchase, you need to remember two systems:

- Conscious spending

- Automated finances

Those two systems will help you save for ANYTHING with enough time and money — and you can do it passively.

The best part? You can then make your expensive purchases guilt-free.

Think about how we typically approach making an expensive purchase:

- Step 1: We see something we like

- Step 2: We feel guilty and know we shouldn’t buy it

- Step 3: We buy it anyway

- Step 4: We feel even MORE guilty later

Repeat until your guilt forces you to relinquish all material goods and devote yourself to a life as a Buddhist hermit.

IWT isn’t about guilt. Though, I have no emotions so it’s difficult for me to relate.

Let’s stop feeling guilty and start using the systems that’ll let us make any expensive purchase we want.

How-to-make-expensive-purchases system #1: Conscious spending

Conscious spending is a fantastic system to spend money on anything guilt-free. It’s the same system my friend uses in order to spend more than $21,000 on going out.

There’s a difference between people who consciously spend on things they love — even if they’re expensive — and people who simply buy whatever they want and deal with the consequences later.

When you consciously spend, you know exactly how much money you have to spend on anything even if it is expensive.

It’s OK to spend on expensive things if it’s done consciously (you know exactly how much you have to spend on specific purchases) and you’re saving/investing appropriately.

But to do that, we need to employ another proven system: Automated finances.

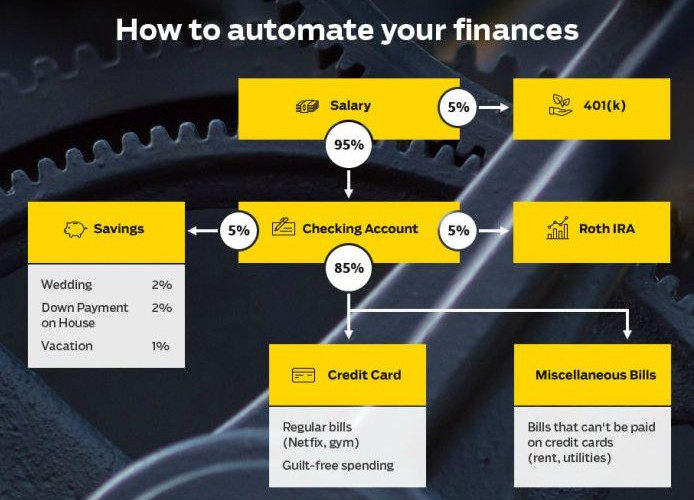

How-to-make-expensive-purchases system #2: Automated finances

Automating your personal finances is the perfect system for anyone who loves:

- Passively saving and investing money

- Knowing exactly how much they have in their checking account to spend (even on expensive things!)

- Not worrying about paying bills/rent/car payment/mortgage/whatever each month

I promise you that once you automate your personal finances you’re going to feel an almost instant change to how you approach money. You’re going to know exactly how much you can spend each month because you got your house together.

No more wondering if you can make rent.

No more trying to find money to pay the light bill.

No more feeling guilty about that new pair of Jordans you want to buy.

And it’s simple: Each month when you get your paycheck, your money is automatically sent to pay your utilities and rent, invested in your Roth IRA and 401k, AND saved in your savings account for your expensive purchases.

It takes just a few hours of your time to set it up — but when you do, you’re good for a long time (or at least until your financial situation changes, like when you get a raise).

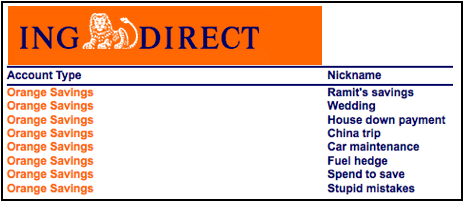

And if you want to save up for any purchase, there’s no better way to do it than with a sub-savings account — a savings account you create to save for specific purchases or events.

Using my automated personal finance system, I use monthly automatic transfers to funnel money into each of my sub-accounts. Now that these transfers are in place, I’m getting closer to each of my goals automatically, month after month, without having to remember to set money aside.

Check out all the different sub-savings accounts I had in my old savings account:

Caption: ING Direct is now Capital One 360. BTW that wedding one is going to be put to good use

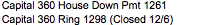

Here’s a look at a few sub-savings accounts I have now:

ING switched to Capital One 360, and I used the money I saved to buy an engagement ring

So set up a sub-savings account and start automatically putting money into it each month. If you need help, check out my article all about sub-savings accounts to get started.

This is an example of using a system to make sure you have the money needed for an expensive purchase. These sub-savings accounts can be for a new car, the new wardrobe, a trip you want to take … anything at all.

You can even set aside money for more nebulous things. See my “stupid mistakes.” Or maybe you can have a “for when my buddy insists on ‘just one more drink’” account.

Now, each time I want to spend money on an expensive purchase, I KNOW I have the money. Because I had been storing a little bit at a time automatically. And I can make the purchase stress-free.

Check out my video below to learn exactly how to set up your automated finances today and get started putting money into your sub-savings account.

The framework for expensive purchases

Along with conscious spending and automated finances, it’s also important to put a framework around expensive purchases. The framework allows you to justify and manage paying for expensive things and can do wonders for you mentally.

What’s the framework? Intentionally putting up a barrier to the purchase. By creating a small intentional barrier, you can force yourself to realize whether it’s really worth it or not.

A while back, I had decided to switch gyms, but I didn’t sign up for a new gym immediately, so there was a time lapse between my memberships. When I finally did, I stopped short for a minute.

In my book, I talk about one study that shows how gym-goers dramatically overestimate how often they actually use their gym membership. So I knew a gym membership was rife with psychological motivators, and I decided to take advantage of that.

To start with, I knew a few things:

- I wanted to get a trainer

- I didn’t mind paying for value

- I wanted to accelerate my growth by paying for someone who is experienced and could help me achieve my goals

But even I’m not delusional enough to believe that I’m different than other people. Think about it: What’s the most common thing that happens with gym memberships? People pay for it, stop going after a month, then feel guilty for not going and paying hundreds and hundreds of dollars in unnecessary gym fees.

Regardless of how much I really believed I’d be different, and how much I really wanted a trainer, I decided to force myself to beat the odds first.

So before I hired a trainer, I wanted to see if I could justify the expense by how often I was making it to the gym. That was the 85% Solution — if I could make it at least 85% of the time, I would do it. I set a simple goal of going to the gym at least three times per week for one month, a gradual goal that would take sustained effort.

It’s important to not set a broad goal, but to be as specific as possible. So my goal was to go on Mondays, Wednesdays, and Fridays. I kept track of the days I went in a notebook.

Now, I didn’t stick to this plan 100%. Some days I didn’t feel like going, so I didn’t. When I didn’t go, I tried to go the next day, or an extra time the next week. Sometimes I was inspired to go on a day off, so I went. Other times I missed a day completely.

At the end of one month, I averaged going to the gym three times a week — right on track. So having met the larger challenge of actually going to the gym, I decided to go forward with the trainer.

Now, let’s figure out how to apply this to your life.

How to decide whether to buy something expensive

Here are a few shortcuts on how to decide whether to buy something expensive:

- Use more. If you want to buy something, use more of what you have before you get something else. For example, I used to constantly buy SAT books in high school (I was a weirdo!). What I should have done was used the SAT book I already had and finished it before getting another one.

- Earn more. Earn more on the side to justify paying for something. This usually relates to time or selling an existing good to pay for something new.

- Dedicate more. Dedicate more time doing something to justify the cost. For me, the time I spent going to the gym justified the cost of a personal trainer.

More practical applications:

Trip to _____: How can you justify this cost? Are you learning the language before you go? If so, set a specific goal. Take language classes for a year. When you hit your goals, give yourself permission to spend the money on the trip.

Expensive makeup: How much unused makeup is sitting in your bathroom drawer right now? Don’t add more to the pile — before spending on expensive new makeup, use up all of what you have first.

Virtual assistant: Same goal as with the cleaning service — if you earn an extra $100/month on the side for three months straight, you can justify hiring a virtual assistant. I’ve talked about ways to use VAs before. Having the support of a good assistant can increase your productivity and efficiency and therefore help you earn even more.

Web designer: Your site has reached 1,000 visitors/day. Remember, I hate bloggers who focus on stats and hardly anyone cares about your design, BUT if more people are visiting your site and its design or user interface is important to you, then go for it.

Upgrading to business/first class: Set a certain percent you want to save. For example, “I want to get at least 40% off first-class tickets by reading Chris Guillebeau Unconventional Guide to Discount Airfare or firstclassflyer.com.” Or simply fly often enough to pay for first class with your travel rewards credit card.

Subscribing to a new service: I’ve written previously about how crazy people go when trying to save money on books, when they should really be trying to extract as much VALUE as possible. You can justify buying an expensive information product if you decide — ahead of time — what metrics it’s going to move the needle for. For example, “I can afford The Scrooge Strategy if I save $100 in the first month.” That’s eminently doable and it gives you a concrete reason to pay for something, even something extremely expensive.

Cleaning service: Give yourself the goal to earn an extra $100/month on the side for 3 months straight. Once you meet the goal, you can justify paying for a cleaning service because it frees up your time to earn more.

These questions to ask before you buy something expensive can be extremely helpful. Be sure to do it if you’re racked with guilt with a possible expensive purchase.

How to make expensive purchases less stressful

When you make an expensive purchase, it doesn’t have to come with guilt and stress too.

If you apply the right systems you can find the money to make expensive purchases AND earn money at the same time.

That’s why I want to offer you something:

In it, I’ve included my best strategies to:

- Create multiple income streams so you always have a consistent source of revenue.

- Start your own business and escape the 9-to-5 for good.

- Increase your income by thousands of dollars a year through side hustles like freelancing.

Download a FREE copy of the Ultimate Guide today by entering your name and email below — and start earning more money today.

How to make expensive purchases is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment