Your credit score is the biggest determining factor for your mortgage.

Lenders look at other things like your income and job history, but none of that matters if your credit score is in the toilet. That’s why knowing the score you need for a mortgage is the first step in buying a house.

What is that credit score though? The score you need to hit to be able to qualify for most conventional mortgages?

At a minimum: 620.

BUT(of course) it’s a bit more complicated than that. The minimum credit score can vary depending on your specific financial situation, your debt-to-income ratio, and which mortgage you choose.

The different types of mortgages

The world of mortgages can often feel like the Wild West — a dramatic and confusing place with unwritten rules that can end your journey at any second. Only those with grit (and a high credit score) can survive.

And in this chaotic land, there are two kinds of mortgages you can get. They are:

- Conventional mortgage. These mortgages are insured by private lenders. The biggest of which are the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae).

- Government mortgage. These are mortgages that are insured by specific government agencies.

Future homeowners also have the option to choose between three different types of loans within government mortgages. Those are:

- FHA loans. These loans are insured by the Federal Housing Administration and given by a private mortgage lender. These mortgages are popular because they require a small down payment when compared to other types of home loans. It’s also much easier to qualify for these loans if you have less-than-perfect credit.

- VA loans. These loans are insured by the Department of Veteran Affairs. As such, they’re only available to military service members (active or discharged). They’re very lucrative to prospective homeowners due to their incredibly low to no down payment.

- USDA loans. Aside from making sure your steak is “Grade A” Angus beef, the Department of Agriculture also doles out home loans for rural areas. These loans are tailored for low-income homeowners and don’t require you to pay mortgage insurance.

Your credit score will be the biggest determining factor on whether or not you get these loans.

So let’s take a look at how different credit scores can affect your mortgage (in classic spaghetti western fashion):

Saddle up, partner. It might get bumpy.

Credit score for mortgage: The good

Having a credit score in the 700 range is the good. It shows lenders that you’re the Clint Eastwood of borrowers — competent, reliable, and deadly in a Mexican standoff.

In fact, you might want to aim it even higher than that.

“You should aim to have your credit in the high 700s if you want to be absolutely ensured a home mortgage,” says Jasmine, a home mortgage advisor at MortgageAdvisor.com. Her job is to help would-be homeowners understand exactly what they need in order to secure a home loan, so she knows her stuff.

According to Jasmin, this puts yourself into prime position to obtain a mortgage without worrying about being denied due to your credit score. This applies to both conventional mortgages as well as government mortgages.

Having a credit in the high 700s is also beneficial because it means you’ll likely get a better interest rate on your mortgage too. This could mean saving thousands over the life of your mortgage (more on that later).

So having your credit score in the 700s is the good … but what about the bad?

Credit score for mortgage: The bad

620 is bad. Mortgage lenders will likely approve you for a loan — though they’ll be suspicious of you and your dastardly ways.

Luckily, it’s not the worst credit score for mortgage. 620 is just the minimum credit you’ll need to qualify for most conventional mortgages with private loan companies like Freddie Mac or Fannie Mae.

“At a minimum, you have to be at least at a credit score of 620 [for conventional mortgages],” Jasmine says. “If it was below that, you would have better luck of applying for an FHA or a VA loan.”

That’s because the credit score minimum for government loans tends to be lower and occasionally non-existent (with the exception of USDA). Take a look:

- FHA minimum: 500

- USDA minimum: 640

- VA minimum: No minimum credit score

Just because this is the minimum credit score doesn’t mean that this should be your goal credit score though. Your credit score affects aspects such as your interest rates as well as your initial down payment.

For example, if your credit score is 500 and you’re applying for an FHA loan, you’re going to need to put down a 10% down payment on your home as opposed to 3.5% down payment if your credit score was 580 or higher.

So that’s the bad credit score for mortgage. Let’s take a dive into the dark pit that is the ugly credit score.

Credit score for mortgage: The ugly

Oof. At less than 500, your credit score looks sorrier than a steer in a stockyard. You best high-tail it towards our articles on improving your credit score to help you out … ‘cause you got a score not even a mama could love.

There are still ways to get a home loan if your credit score is less than 500 (such as getting a VA loan). However, you’re going to want to improve that credit score if you want a good interest rate and low down payment on the house.

This can end up saving you thousands over the length of your mortgage.

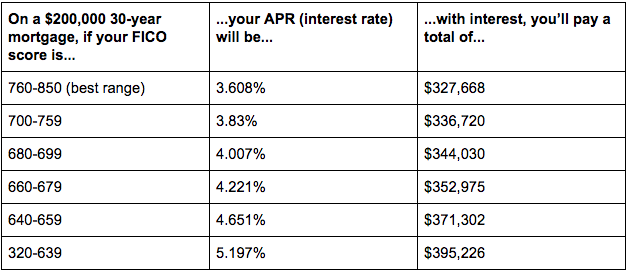

Take a look at this chart:

Source: MyFico.com. Data calculated in June 2017.

Imagine two home buyers. One has a great credit score of 760 and the other has a bad credit score of 500.

The one with the bad credit score is going to end up paying over $67,000 more in interest than the one with fantastic credit.

Don’t be the one with an ugly credit score. Instead, start taking steps to improve your credit score today.

How to improve your credit score for mortgage

If your credit score is bad then you’ve come to the right place, partner. We have a wealth of resources at IWT to help you get out of debt and improve your credit score faster than a jackrabbit in a hurricane — or something.

Anyway, here’s a quick overview on our proven system to improving your credit score:

- Step 1: Get out of debt fast. Debt is the number one barrier to living a Rich Life. That’s why if you want to improve your credit score and get a Big Win, you’re going to want to get out of debt as fast as possible.

- Step 2: Automate your credit card payments. The biggest determining factor of your credit score is your payment history. That’s why you’re going to want to automate your personal finances so you can do things like invest and pay down debt easily and painlessly. It also takes the hassle out of paying your bills each month.

- Step 3: Keep your accounts open — and put a recurring charge on them. 15% of your credit score is determined by the length of your credit history. That’s why you’re going to want to keep any credit card accounts open BUT keep just one or two recurring payments on them (e.g., Netflix, utility payments, rent).

- Step 4: Get more credit — but only if you have no debt. 10% of your credit score is determined by how many types of credit you have in use. That’s why you’re going to want to actually get more credit once you’re out of debt.

For more information on those systems, be sure to check out our article on how to improve your credit score.

If you want even more resources on getting out of debt and getting a better score, be sure to check the articles below:

- How to get out of debt fast

- How I got my credit scores and report for free

- How to check your credit score and what to do about it

Improve your credit score for mortgage = Big Win

To help you even more, we’d like to offer you something: The first chapter of Ramit’s New York Times best-seller “I Will Teach You to Be Rich.”

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

It includes the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

Credit score for mortgage: The good, the bad, and the ugly is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment