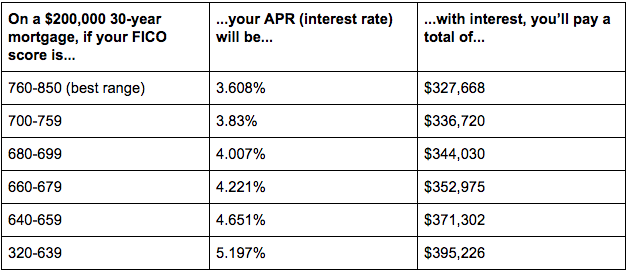

Improving your credit score is potentially worth nearly $100,000.

Consider two people:

- Abby, who has great credit (760)

- Derek, who has poor credit (620)

In their 30s, they decide to buy houses of similar prices. How much do you think they each pay?

Spoiler alert: Not the same amount.

Check out the graph below:

Source: MyFico.com. Data calculated in June 2017.

Because Derek has poor credit, he’ll end up paying nearly $68,000 more in interest than Abby — whose credit is awesome.

Don’t be like Derek. Instead, be like my readers who improved their credit scores by listening to some Indian dude online:

Improving your credit score can seem like an incredibly daunting task — but it’s actually pretty straightforward as long as you have the right systems in place.

And in a world where nearly 110 million Americans have NEVER even checked their credit score, making sure you have a good one will put you ahead of the curve when it comes to things like attaining a home mortgage, refinancing your student loans, buying a car, or even renting an apartment.

It’s also an incredibly easy way to get started on earning a Big Win. That’s because credit has a far greater impact on our finances than saving a few dollars a day on a cup of coffee.

Luckily, we have the exact systems to help you get started improving your credit score. They are:

- Get out of debt fast

- Automate your credit card payments

- Keep your accounts open — and put a recurring charge on them

- Get more credit — but only if you have no debt

To understand why these systems work, you need to first know how your credit score works.

(If you already know how credit scores work, click here to jump down to the systems.)

Before you improve your credit score…

There are two main components to credit history:

- Credit report. This is an all-inclusive report that potential lenders (i.e. people considering lending you money for things like cars and homes) use to gain basic information about you, your accounts, and your payment history. This report tracks all credit-related activities, although recent activities are given a higher weight.

- Credit score. This is often called your FICO score because it was created by the Fair Isaac Corporation. It’s a single number between 300 and 850 that represents your risk to lenders. Think of it like the SparkNotes of your credit history. The lenders look at this number along with other pieces of information such as your salary and age to decide if they’ll lend you money for credit like a credit card, mortgage, or car loan. They’ll charge you more or less for the loan depending on the score, which signifies how risky you are.

And while your credit score and credit report are two entirely different things, your score comes from the information in your report.

The actual number is determined by the following information and their associated weight in relation to your score (credit score formula courtesy of Wells Fargo):

What your credit score is based on:

- 35% payment history. How reliable you are. Late payments hurt you.

- 30% amounts owed. How much you owe and how much credit you have available, or your “credit utilization rate.”

- 15% length of history. How long you’ve had credit. Older accounts are better because they show you’re reliable.

- 10% how many types of credit. If you have more lines of credit open, the better your score will be.

- 10% account inquiries. How many times you have or a lender has checked your credit background.

What your credit report includes:

- Basic identification information.

- A list of your credit accounts.

- Your credit history (whom you’ve paid, how consistently you paid, and any late payments).

- Amount of loans.

- Credit inquiries or who else has requested your credit information (e.g., other lenders).

Think of yourself as a football team. The credit report is all the plays you run and the credit score is the cumulation of all the goal point units you score in the game match…

I’m such a HUGE fan of football. Can’t you tell?

“My credit score is XXX. What’s that mean?”

Your credit score will be within a range of 300 and 850. The range determines whether or not your score is solid — but a good rule of thumb is the higher your credit score, the better you’re off.

Below are a few ranges from Experian and what they may mean for you.

- 850 – 800: This is a fantastic spot to be with your credit score. If you’re here, you’ll have no problem securing a loan or a good down payment percentage on your home.

- 799 – 740: Though not the top spot, this is still a very good area to be. You’ll be offered great rates here.

- 739 – 670: This is an okay credit score range — though not great. Focus on closing unused accounts and consolidating loans to move this number up.

- 669 – 580: This is when you should start worrying. If your credit score is here, you’re considered a “subprime” borrower and won’t get very good rates. Reduce your debt load and work on your payment history in this band.

- 579 – 300: Here you’re likely not to be considered for a loan at all and will run into numerous issues with things like getting approved for apartments. You should find a non-profit credit counselor and ask for help.

It’s ridiculously easy to check your credit score. It’s so easy, I want you to do it right now.

Seriously. Checking your credit score is incredibly simple. I suggest starting at Credit Karma or Mint.

Once you have the number in front of you, it’s time to take some steps to improve your credit score.

How to improve your credit score

You don’t need to become a credit weirdo like me and read 50 books on credit optimization to raise your credit score. You can actually ignore most advice and simply do a few, key things to dramatically improve your score.

In fact, there are four major tips that will have the biggest impact in improving your credit score.

- Improve your credit score tip #1: Get out of debt fast

- Improve your credit score tip #2: Automate your credit card payments

- Improve your credit score tip #3: Keep your accounts open — and put a recurring charge on them

- Improve your credit score tip #4: Get more credit — but only if you have no debt

A while back, I asked my readers how they improved their credit scores. Their answers revealed that improving your credit score isn’t rocket science. It’s about being disciplined and having some no-nonsense financial systems in place.

I’ve included some of the best answers in here to show you that it is possible to improve your credit score and to give you insight into how you can do it yourself.

Improve your credit score tip #1: Get out of debt fast

Too many people think that since they have debt, they should game the system and play the 0% balance transfer game, switching balances from card to card to save a few percentage points on debt interest.

Yeah!! Let’s stick it to the man!

What I’ve found is that they spend more time transferring balances from card to card instead of actually paying their debt off. That’s ridiculous, especially when you consider that 30% of your credit score is calculated based on how much you owe.

Instead, I want you to pay down that debt using my five-step method. I’ve written about this system before in my post about how to get out of debt, but I’ll give you a breakdown on the exact same system that’s helped thousands of readers finally escape their debt.

Here’s a brief overview:

- Step 1: Find the exact amount you owe.

You’re probably thinking, “Well, duh. Of course you should know how much debt you have,” but it’s actually wayyy harder than you think.

In fact, a study found that many don’t actually know how much debt they owe. It makes complete sense too. Humans are sensitive creatures who would rather run from their problems than tackle them head-on.

However, this just leads to you blindly paying the minimum payment instead of actually owning your debt. Only then can you start a good strategy to get rid of it.

- Step 2: Decide what to pay off first.

Not all debt is created equal. You might have debt across several cards, each with their own balance and interest rate.

There are typically two schools of thought when it comes to credit card debt: Pay off the highest interest rate first, or pay off the lowest balance first.

In the standard method, you pay off the card with the highest APR since it’s costing you the most. The minimum leaves you saddled with more debt. Even $20/month more helps save you a lot of money.

In the alternative method, you’re paying off the lowest balance first while paying the minimum on your other credit cards. This is also known as the Snowball method and was popularized by Dave Ramsey. While it isn’t technically the most efficient method, it’s enormously rewarding on a psychological level to see a credit card paid off.

Bottom line: Don’t spend more than five minutes deciding. Just pick a method and do it.

- Step 3: Don’t be tempted.

If you want to get rid of your debt for good, you can’t keep adding to it. That’s why you need to stop yourself from taking on more, at least until you’ve gotten rid of your existing debt.

So do yourself a favor and get rid of your credit cards (at least until you’re out of debt). Give them to a friend or a family member to hold on to. If you have a safety deposit box, put them in there for a while. Some people have literally frozen their cards in a block of ice so they have to wait a few hours before using them. Anything works as long as your cards are out of sight and out of mind.

- Step 4: Negotiate a lower interest rate.

Did you know that you can actually save over $1,000 in a single phone call with your credit card company? Using simple negotiation systems, you can lower your credit card’s APR and put that money back in your pocket. For the exact scripts that you can use during your negotiations, be sure to check out my full article on eliminating debt.

- Step 5: Decide how you’re going to pay your debt.

There are a number of ways you can approach this. You can use the money you got from step four and put it towards chipping away at what you owe. You can also tap into hidden income to free up some money. If you’re really enterprising, though, you can start EARNING more money — I’ll explain that in a little bit.

A while back, I created a video all about negotiating your debt. Don’t be thrown off by how I filmed it using a potato. The advice can still help you expertly negotiate with credit card companies.

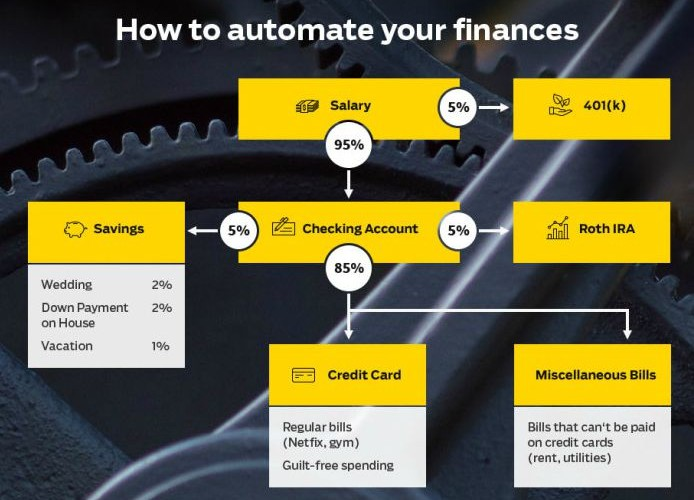

And if you are in debt, one system that can help you tackle it is through automating your finances.

Improve your credit score tip #2: Automate your credit card payments

35% of your score (the biggest portion) reflects your payment history, so even missing one payment can cause your credit score to drop 100 points, jack your APR up 30%, add $200+/month to your monthly mortgage payment (insane, I know), and more.

By setting up automatic payment using my IWT system, you won’t have to worry about manually paying your bills each month or accidentally forgetting a payment and getting slapped with a huge penalty.

The best part? Once you automate your personal finances, you’ll automatically invest, save money, and pay off all your bills at the beginning of the month — not just your credit card statement!

For more information on how to automate your finances, check out my 12-minute video where I go through the exact process with you. (Try not to be too impressed with my awesome whiteboard art.)

You should ideally be paying off your entire credit card balance each month, but if you can’t, you can still improve your score by paying at least the minimums, on time, every month.

Improve your credit score tip #3: Keep your accounts open — and put a recurring charge on them

So many times, when people get motivated to “do something” about their credit cards, the first thing they do is close all the cards they haven’t used in a long time.

Sounds logical: Let’s clean out the old cobwebs in our wallet!

In reality, this is a bad idea: 15% of your credit score reflects the length of your credit history, so if you wipe out old cards, you’re erasing that history.

Plus, you’re also lowering your “credit utilization rate,” which basically means (how much you owe) / (total credit available).

For nerdy people (aka half my readers), here’s the math of your credit utilization score — plus a little-known caveat:

“If you close an account but pay off enough debt to keep your credit utilization score the same,” says Craig Watts of FICO, “your score won’t be affected.” (Most people don’t know this.)

For example, if you carry $1,000 debt across two credit cards with $2,500 credit limits each, your credit utilization rate is 20% ($1,000 debt / $5,000 total credit available).

If you close one of the cards, suddenly your credit utilization rate jumps to 40% ($1,000 / $2,500). But if you paid off $500 in debt, your utilization rate would be 20% ($500 / $2,500) and your score would not change.

A lower credit utilization rate is preferred because lenders don’t want you regularly spending all the money you have available through credit — it’s too likely that you’ll default and not pay them anything.

NOTE: If you’re applying for a major loan — for a car, home, or education — don’t close any accounts within six months of filing the loan application. You want as much credit as possible when you apply. However, if you know that an open account will entice you to spend, and you want to close your credit card to prevent that, you should do it. You may take a slight hit on your credit score, but over time, it will recover— and that’s better than overspending.

Bottom line? Even if you don’t use a card, keep it open. Put a small charge on it — say, $5/month — and automate it each month. This way, you ensure your card is active and maintains your credit history.

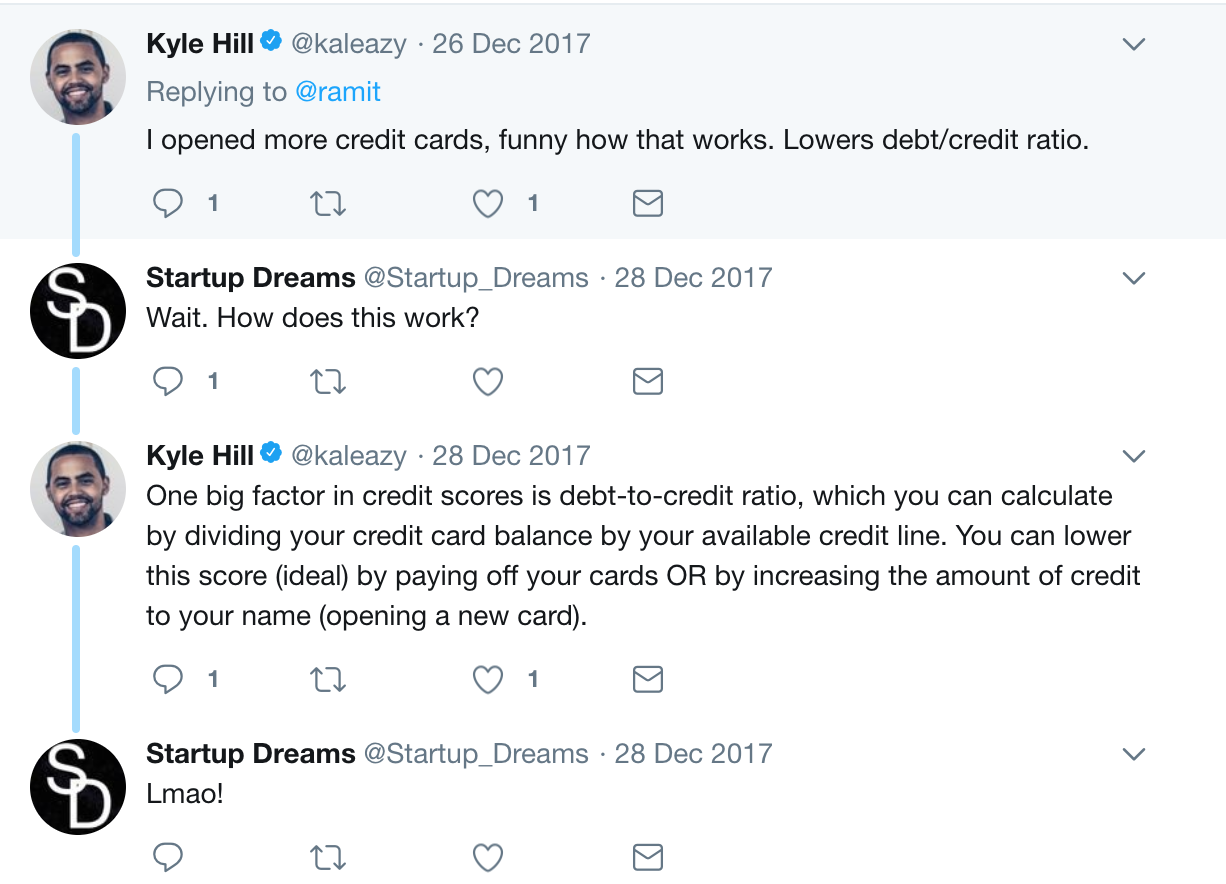

Improve your credit score tip #4: Get more credit — but only if you have no debt

I cannot stress this enough: This system is only for financially responsible people. That means you have zero debt and you pay your bills in full each month. It’s not for anyone else.

That’s because this system involves getting more credit to improve your credit utilization rate. This falls in the same 30% bucket as your debt does when it comes to your credit score.

To improve your credit utilization rate you have two options: Stop carrying so much debt on your credit cards (we covered that above) or increase your total available credit. Since you should already be debt-free, all that remains for you to do is to increase your available credit.

Here’s a great script you can use when you call your credit card company:

YOU: Hi, I’d like to increase my credit. I currently have $5,000 available and I’d like $10,000.

CC REP: Why are you requesting a credit increase?

YOU: I’ve been paying my bill in full for the last 18 months and I have some upcoming purchases. I’d like a credit limit of $10,000. Can you approve my request?

CC REP: Sure. I’ve put in a request for this increase. It should be activated in about seven days.

I request a credit-limit increase every six to 12 months because it’s such an easy win. I suggest you do the same.

Remember: 30% of your credit score is represented by your credit utilization rate. To improve it, the first thing you need to do is get debt-free. Once that’s done, THEN increase your credit.

Improve your credit score = Big Win

Take the time to start improving your credit score using the four systems outlined above — and to help you even more, I’d like to offer you something: The first chapter of my New York Times bestseller I Will Teach You to be Rich.

It’ll help you tap into even more perks, max out your rewards, and beat the credit card companies at their own game.

I want you to have the tools and word-for-word scripts to fight back against the huge credit card companies. To download it free now, enter your name and email below.

How to improve your credit score in 4 systems is a post from: I Will Teach You To Be Rich.

Via Finance http://www.rssmix.com/

No comments:

Post a Comment